CCJ‘s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

Market conditions for trucking companies, based on metrics like fuel prices, freight demand and capacity, continues to reflect a strong environment for carriers, according to FTR’s Trucking Conditions Index for May.

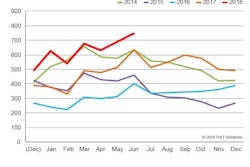

A hot economy is yielding strong freight demand, and the industry is operating at full capacity, which has driven rates to record highs. FTR says trucking conditions “are only expected to improve as freight season enters its peak.” FTR says rates could climb 13 percent in 2018 from last year. These conditions could moderate some into 2019, as fleets take hold of equipment ordered this year and expand their capacity, says FTR.

“Key indicators of freight demand such as manufacturing and construction remain strong,” says Avery Vise, FTR’s vice president of trucking research. “Aside from any major negative impacts due to trade relations, which is difficult to forecast at this stage, freight demand should lead to even stronger trucking conditions in the near term.”

“On the other hand, despite aggressive recruiting, a very tight labor market has allowed trucking companies to add only modestly to the driver force, keeping the industry at full active utilization,”

he says. “Therefore, two critical external factors in coming months will be trade and the labor market. Another factor will be the fuel environment as the direction of diesel and crude prices is unclear. Fuel pricing has risen a couple of times recently only to moderate slightly each time.”