“He who has the drivers wins.” That’s a comment Gordon Klemp, president of the National Transportation Institute, heard recently from a long-time subscriber to his National Survey of Driver Wages. Facing the tightest driver recruiting market in decades, that fleet had just raised pay 15 cents in an effort to try and “stay ahead of the market,” Klemp says.

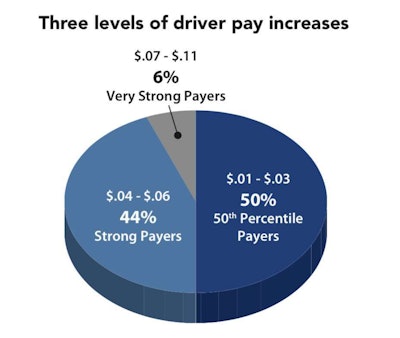

Traditionally, carriers have split into two segments relative to driver pay increases — aggressive movers and less aggressive movers. This year, NTI President Gordon Klemp has noticed a shift to three segments, with a small group of carriers raising pay at a more accelerated pace. (Data from the National Transportation Institute)

Traditionally, carriers have split into two segments relative to driver pay increases — aggressive movers and less aggressive movers. This year, NTI President Gordon Klemp has noticed a shift to three segments, with a small group of carriers raising pay at a more accelerated pace. (Data from the National Transportation Institute)Just over 6 percent of carriers Klemp tracks have made such aggressive pay increases – a group he calls very high payers – that have raised pay around 7 to 11 cents per mile through the second quarter of 2018. Historically, Klemp has grouped carriers into lower 50th percentile payers and high payers. Assuming 100,000 driving miles annually, drivers working for the high and very high paying carriers should take home on average $3,000 and $6,000 more, respectively, than those working for the 50th percentile carriers with less aggressive driver pay bumps, Klemp says.

Carriers that have raised pay significantly “weren’t low-ballers,” Klemp says. They were carriers “in the top half to start with who made a very aggressive move and they think they have the chance to capture profitable business right now,” Klemp says. He’s seen large increases across all types of carriers – dry van, flatbed and refrigerated.

Many carriers have raised pay twice since late fourth quarter 2017, Klemp says, a fact that surprised him. “Everyone is looking for the sweet spot in their market, but it is complicated by the growing difficulty of finding qualified drivers and the quickly shifting driver compensation landscape,” he said in his Q2 NSDW report. Making the situation even more difficult is the need to buy time to adjust freight rates to support pay increases, he says. Assuming the freight rate market remains strong, more than half of carriers Klemp tracks say they may raise pay again this year.

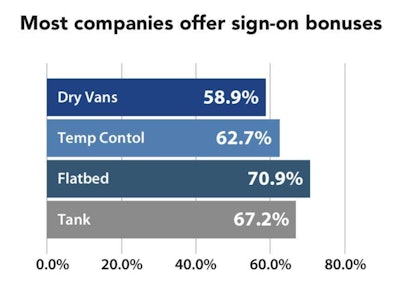

(Data from the National Transportation Institute)

(Data from the National Transportation Institute)Most carriers are also offering sign-on bonuses, a trend that is spreading to niche haulers, such as in the explosives sector, as well as private fleets, Klemp says. The widest use of sign-on bonuses remains in the team driver segment, where bonuses as high as $30,000 or more are common.

A major shift in the driver recruiting landscape is the difficulty even private fleets now have in hiring qualified drivers, Klemp says. Private carriers pay on average nearly 29 percent more than for-hire carriers, offer regular home time, driver-friendly freight, excellent benefits and first-class equipment, giving them “the pick of the litter” of for-hire drivers, Klemp says. Two factors are now making the driver situation difficult for private fleets, Klemp says: their drivers are retiring in record numbers and they lack a core competency in recruiting drivers because they’ve never had to compete for drivers. Klemp predicts the pay spread between private and for-hire carriers will continue to shrink as they try to distance themselves from for-hire.

By the end of the year, Klemp says, pay will have increased 12-15 percent, a significant bump but still not enough to make up for the 16-19 percent shortfall of driver wages when adjusted for inflation. “This will help existing drivers, but the number will have to get bigger in order to attract people” from other industries, Klemp says. That will be necessary because at 3.8 percent unemployment, “we’re frozen in place on driver supply,” Klemp says, and predicts: “We’ll have some serious driver wars.”