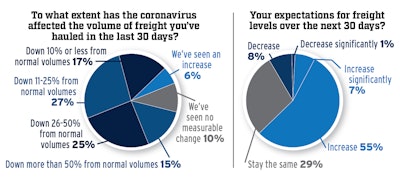

Carriers surveyed by CCJ in over the past week largely have reported steep slowdowns in freight volumes in the past 30 days. But many of those fleets, 62%, said they expect freight to begin to rebound in the coming 30 days.

Carriers surveyed by CCJ in over the past week largely have reported steep slowdowns in freight volumes in the past 30 days. But many of those fleets, 62%, said they expect freight to begin to rebound in the coming 30 days.Even as many shippers begin to reopen their facilities and return to operation, suppressed freight volumes and slouched shipping rates continue to top freight carriers’ post-pandemic concerns.

Freight volume last month for most carriers was down between 11% and 50% from normal levels, according to a CCJ survey that measures the coronavirus’ impact on motor carriers.

Among carriers with 100 trucks or less, 25% said freight volume was down 26-50% from normal volumes. Among fleets with more than 100 power units, 41% said volume has dipped 11-25% from normal levels.

Smaller carriers are fairing slightly better in the chase for freight, with 14% reporting no measurable change compared to just 4% of larger carriers. Both groups reported a 6% increase in freight volume last month and 17% noted a drop of 10% or less. Only 15% of carrier respondents reported a volume drop of more than 50%.

“We were down a total of 25% for the month of April,” wrote a for-hire bulk carrier with up to 50 trucks. “We seem to be back to normal in May.”

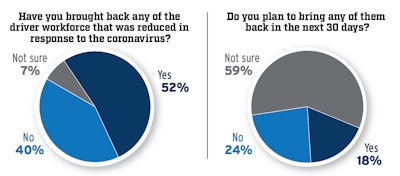

Of the 27% of carriers who said they had decreased their driver workforce since the pandemic began, more than half (52%) said they have re-hired drivers.

Of the 27% of carriers who said they had decreased their driver workforce since the pandemic began, more than half (52%) said they have re-hired drivers.The majority of respondents (62%) expect volumes to climb this month with one Virginia-based carrier with up to 100 trucks noting a looming seasonal increase in demand.

More than 70% of respondents instituted work-from-home policies through the pandemic for either support staff (42%) or management (31%), and fleets appear anxious to bring those employees back to their desks.

More than 70% of respondents said remote workers would be recalled and required to work from the office when they can safely do so, compared to nearly 30% that said they will give employees the option to remain remote.

“We will selectively allow a work-from-home schedule with employees who have proven to be productive from home working through the pandemic,” wrote a for-hire carrier with up to 500 trucks.

In response to the negative business environment, many carriers canceled truck (23%) and/or trailer (17%) orders, and are unlikely to re-file those orders in 2020. About 60% of the companies who canceled truck and trailer orders said they do not plan to order those assets this calendar year.

The total number of people employed in trucking fell by 1,200 in May, according to preliminary figures released late last week by the Department of Labor and carrier employees laid off during the pandemic are starting to filter their way back into the workplace. More than 50% of respondents said they have recalled laid off drivers in the last 30 days and another 18% said they planned to do so by the end of this month. Almost 45% of respondents said they had recalled non-driver staff and another 14% said they planned to do so by June 30.

When those employees finally return, they’ll likely notice a heightened emphasis on sanitation and cleanliness. To combat the threat of viral-spread, 72% of respondents said they have increased cleaning of facilities and 88% said those practices would remain in place once the pandemic subsides.

Carriers scored business conditions over the last two weeks (ending June 8) a 5.04, where 1 is the worst week ever and 10 is the best week ever – the highest this score has been in two months. The group forecast the coming week at 5.57, and 6.11 over the next 30 days.

“Skinny margins are likely for the months ahead,” added another. “We will have to be very smart but nimble in adjusting to the market conditions and demand for our services.”

Freight pricing continues to be carriers’ top challenge (56%) as the economy reopens, with finding new business and cash flow, as one carrier noted it “very difficult to get business credit in these times,” tied for second at 39% each.

“Volumes are decent but pricing is off considerably,” wrote a for-hire carrier with up to 250 trucks.

Another respondent added that all shippers are looking to trim costs, stretch term and reduce rates, which “will make dedicated contract renewals a challenge.”

Recruiting new drivers (37%) and retaining drivers (34%) rounded out carriers’ top 5 challenges.

Carriers expect the lingering effects of COVID-19 to have a moderate effect (5.67, where 1 is minimal impact and 10 is significant impact) on day-to-day trucking through the rest of the year.