This year has seen the largest U.S. tariff increases since 1930 and a new study from Michigan State University sheds light on how global supply chains have been reshaped.

“Unlike previous trade wars, the 2025 actions came with extreme uncertainty,” said Jason Miller, lead author of the study and the Eli Broad Endowed Professor in supply chain management at Michigan State University.

The study offered a theoretical framework for firms' response to tariffs.

The study offered a theoretical framework for firms' response to tariffs.

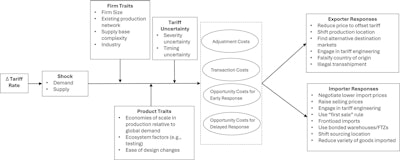

The study, which introduces a framework designed to help researchers and policymakers navigate the rapidly evolving trade landscape, outlines a theoretical framework that identifies three main cost categories firms face in response to tariff volatility: adjustment costs (such as switching suppliers or production sites,); transaction costs (including renegotiating contracts or onboarding new partners); and opportunity costs, which arise from responding too early or too late to shifting policies.

“The crux of our framework is that changes in tariff levels cause firms to experience demand or supply shocks, which in turn can trigger a variety of behavior,” said Miller. These responses may include lowering export prices or redirecting goods to other markets.

The study noted that these costs shape how firms make critical decisions, whether to relocate production, renegotiate deals, or absorb or pass on rising costs to consumers.

While some actions may fall within legal bounds, Miller noted that others may cross into misconduct (like mislabeling the country of origin), highlighting the need for close monitoring.

“I’ve spoken with industry professionals who have described large importers having at least five, and sometimes 10, different plans sketched out because they cannot anticipate what the final form of tariffs will look like,” Miller noted.

During its latest earnings call, FedEx (CCJ Top 250, No. 1) expressed ongoing challenges in providing full-year financial guidance, citing persistent uncertainty around global tariffs and trade dynamics.

Instead of issuing annual projections, the company limited its outlook to the first quarter, noting that clearer market conditions are needed before offering broader forecasts.

“The global demand environment remains volatile,” said FedEx CEO Raj Subramaniam, emphasizing the instability that continues to cloud both operational planning and revenue expectations.

One major factor has been tariff-related disruptions, particularly in the Asia-to-U.S. trade lane, where impacts (largely driven by China) resulted in a $170 million hit to adjusted operating income.

Meanwhile, J.B. Hunt (No. 3) also highlighted the effects of shifting trade conditions during its second quarter earnings call with analysts. Executives announced that peak season surcharges would be implemented earlier than usual this year due to the unpredictability in global freight patterns – a decision driven by the lack of reliable forecasting and heightened risk of demand swings, said Spencer Frazier, executive vice president of sales and marketing.

Frazier added many customers are altering sourcing strategies, pulling forward inventory, or pausing shipments together as they adapt to evolving global trade realities. Others are taking a demand-driven approach or shifting manufacturing and origin pints in response to geopolitical shifts.

Customer feedback about upcoming volume was also mixed, said Darren Field, executive vice president and president of intermodal. Some expect a bump in July, while others foresee a peak similar to last year. Given the conflicting signals, the company is taking a more flexible approach to avoid being blinded.

Impact on consumers

While the research is grounded in supply chain theory, its implications can ripple through the economy.

Products like fruits, coffee, and other food imports are sensitive to changes in trade policy, said David Ortega, a study co-author and the Noel W. Stuckman Chair in food economics and policy at MSU. “When tariffs are imposed or threatened, that leads to price increases, sourcing challenges and more strain on lower-income households.”

Ortega pointed out that commodities with little or no domestic production, such as bananas or pineapples, are especially vulnerable.

The paper also charts out multiple avenues for future research and provides a curated toolkit of data sources, including firm-level trade data, import/export price indexes, and industry-specific data.