ArcBest (CCJ Top 250, No. 9) is optimistic about its potential for long-term growth even as it navigates market headwinds.

The company held its investor day in New York this week, wherein management presented its technology initiatives, efficiency plans, and financial and business targets.

“Our strategy is clear, but we’ve navigated one of the longest and deepest freight recessions in recent memory,” said Matt Beasley, CFO of ArcBest. “It’s been a tough environment for everyone in the space, but despite those headwinds, ArcBest has continued to deliver solid results.”

“The recent interest rate cut and likelihood of more to come gives us reason to be optimistic,” he added.

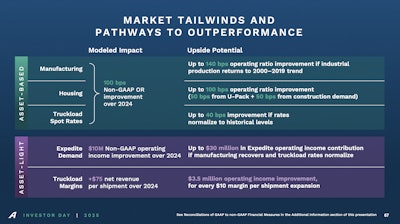

Interest rate cuts are expected to stimulate manufacturing and housing, Beasley said, which are key drivers of freight demand, and the company sees potential upside beyond its current midpoint targets.

In its asset-based segment, Beasley explained that a return to normal trends in industrial production, housing activity, and truckload pricing could improve the operating ratio.

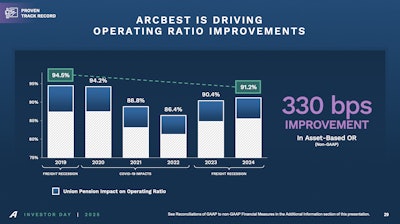

The company is targeting an improvement in its operating ratio from 91% in 2024 to a range of 87% to 90% by 2028. In 2019, the company’s operating ratio was 94.5%.

Beasley noted that growth will be driven by increasing revenue per shipment cost by 80 basis points per shipment annually through 2028, while also growing shipments steadily in the low single digits.

ArcBest also plans to expand its core less-than-truckload business. President and CEO-elect Seth Runser noted that LTL added roughly 2,200 shipments per day in 2024, with new customers growing tonnage by 70% by their second year.

On the asset-light business, Beasley said ArcBest is targeting an operating income of $40 million to $70 million by 2028.

Growth will be driven from managed solutions, which Runser said has been a “true success story.” Since its launch in 2017, daily shipments have been growing at an annual rate of 44%, with 90% retained customers. Even during the freight recession, Runser noted that daily shipments grew more than 60% and managed to remain profitable.

“Today, our managed (solutions) pipeline has surpassed $1 billion and will continue to expand, fueled by our growth initiatives,” Runser said.

ArcBest’s strategic shift toward small and mid-sized truckload customers is also paying off, he said. Truckload has shifted from 80% enterprise exposure in 2021 to 60% today. SMB shipments are producing about 60% higher profit per load, he said.

Beasley said stronger manufacturing and truckload rates could also result in greater improvement in operating ratios and income.

“Even small changes can have a big impact,” he said. “Our targets only assume a partial recovery; if things bounce back faster and we keep doing what we do best, we see real potential to outperform these targets.”

Overall, the company projects $400 million to $500 million in operating cash flow by 2028, enabling continued investment in high-return areas like real estate, equipment and technological innovation.

[RELATED: ArcBest improves warehouse efficiency with new forklift technology]

Technological innovation as its competitive edge

Launched in 2020, Runser said ArcBest’s proprietary dynamic pricing model has scaled rapidly and has been quite beneficial for customers. Now processing about 250,000 quotes daily, it has boosted revenue per shipment by nearly 50%.

In addition, ArcBest also launched 70 optimization projects, with nearly half fully implemented. This includes AI-driven route planning, automated scheduling and digital quoting tools.

City route optimization tools, which is in its phase one and uses AI to reduce manual tasks, improve route planning and maximize asset utilization, are contributing to over $13 million in annual savings.

Runser said it’s now advancing to two phases: phase two uses daily demand predictions to streamline pickup routes, and phase three introduces dynamic routing, which includes automated, customized routes generated in near real time with flexibility for human adjustments based on local expertise.

A new platform, ArcBest View, will launch in 2026 to fully integrate quoting, booking and tracking across all services to enhance customer experience.