The truckload market indicates signs of recovery in late 2026 as moderate rate growth and supply-side pressures surface, though demand remains flat, according to a new report.

Meanwhile, less-than-truckload rates reached a record high in the fourth quarter as carriers maintained pricing discipline despite weak demand.

Supply side indicates recovery signals in truckload

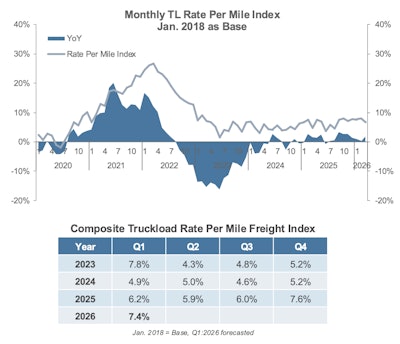

The TD Cowen/AFS Freight Index, which examined freight data from more than 1,800 clients across all sizes and industries, reported that truckload linehaul cost per shipment dropped 8.6% in Q4 2025, while miles per shipment decreased 10% quarter over quarter.

According to the report, the truckload sector continued to face soft demand throughout Q4 2025. The ATA Truck Tonnage Index inched only 0.2% in November 2025 after substantial drops of 1.9% in October and 0.8% in September.

Capacity becomes more constrained as carriers exit the market and industry consolidation accelerates. Additional pressure could come from stricter CDL compliance enforcement. In December 2025, the Department of Transportation announced that roughly 9,000 drivers could be removed from service for failing to meet language proficiency standards.

However, a critical question remains: “Will the capacity that exits the marketplace actually exit, or will it reappear in a different structure?” said Aaron LaGanke, vice president of freight services at AFS Logistics.

In the near term, the TD Cowen/AFS Truckload Freight Index is projected to ease to 7.4% in Q1 2026, with a modest 1.1% year-over-year gain. Similarly, the TL rate per mile index is projected to sustain positive year-over-year growth at 7.4% in Q1 2026.

Macroeconomic indicators show improvement, the report noted. The US economy expanded at an annual rate of 4.3% in Q3 2025, the strongest pace in two years, driven by consumer spending, export gains, import declines and increased government expenditure.

However, the truckload freight market shows “only tentative signs of recovery in late December 2025,” it noted. Flat demand and uncertainty on trade policy adjustments continue to temper the freight market’s progress.

LaGanke said real recovery requires more than rate stabilization. Persistent confidence would depend on “sustained growth in freight volumes (not just rates) driven by inventory replenishment, improving goods consumption, and rising industrial output, with import volumes translating into higher domestic truckload moves.”

These demand signals must also be persistent across multiple shipper verticals for several months, LaGanke added, including through seasonally weaker periods, rather than being driven by short-term disruptions or capacity exits.

In a 2026 recovery scenario, truckload brokerage is positioned to see margin expansion earliest, LaGanke said, as this is the mode “where capacity may be impacted the most and pricing can move quickly in the spot market. Contract pricing will take more time to catch up, but the spot market can move quickly.”

LTL sees rate strength amid volume softness

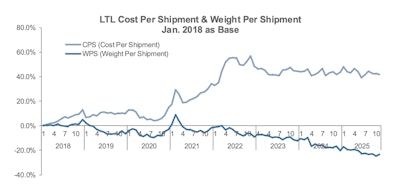

Less-than-truckload cost per shipment declined by 0.3% quarter over quarter in Q4 2025, while average weight per shipment fell by 1.6%. The gap between these two metrics widened in Q4 2025 as weight per shipment continued declining at a faster pace than cost per shipment. The trend reflected continued soft demand and continued modal shifts within the LTL market.

Since Q2 2022, LTL cost per shipment has remained more than 40% above January 2018 levels, even as weight per shipment has dropped by over 20% during the same timeframe. The divergence highlights how LTL carriers “maintained yield discipline and capacity balance,” the report noted. Despite volume weakness, weight per shipment decreased 7.1% year over year in Q4 2025, while cost per shipment declined 4.5% in the same period.

LTL carriers focused on network discipline rather than volume, said Mich Fabriga, VP of LTL pricing at AFS Logistics.

“LTL networks are asset-intensive and density-driven, making it more rational to protect yield than to chase marginal volume that degrades network efficiency,” he said.

Carriers have become increasingly selective about the freight they accept, “pricing for network fit (both linehaul and pickup & delivery), cube, and crossdock efficiency instead of market share,” Fabriga explained.

Carriers no longer chase volume at the expense of cost behavior, Fabriga said. Even with soft manufacturing demand and lighter shipments, carriers have maintained pricing discipline using advanced revenue management and balanced capacity.

In Q1 2026, the TD Cowen/AFS LTL Freight Index is projected to moderate to 66.1% from a record high of 67.9% in Q4 2025, primarily due to seasonal patterns. Despite this 1% quarter-over-quarter decline, the index projects year-over-year growth for the ninth consecutive quarter.

With continued demand softness, the report said LTL carriers are focused on network efficiency, advanced revenue management, and disciplined pricing strategies to protect margins and profitability.

Trade policy uncertainty and elevated interest rates continue suppressing manufacturing activity, constraining near-term prospects for LTL market improvement, the report said. In December 2025, the ISM Manufacturing PMI remained in contraction for the tenth straight month at 47.9%, reflecting weak new orders, and employment offset modest production gains.