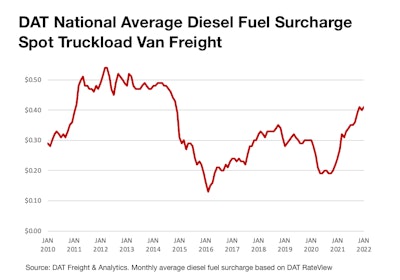

The national average for a gallon of on-highway diesel crossed the $4 mark this month for the first time in almost 8 years, and Russia's invasion of Ukraine isn't going to be a contributing factor in bringing it back down.

Russia is the world's second largest exporter of oil. On the heels of the conflict, for which Moscow has drawn political and financial sanctions from the U.S. and many of its European allies, Goldman Sachs moved up its forecast of $125 for a barrel of crude oil (bbl) from the summer of 2023 to this summer.

"I'm not necessarily a believer," said Tom Kloza, global head of energy analysis at Oil Price Information Service (OPIS), "but that would equate to $4.25-$4.75 per gallon pump prices for gasoline and diesel except for California, which would be above $5 gallon for both."

As Russian troops crossed the Ukrainian border barrels of crude oil late in the week bounced between just over $100 to just under $100, but Kloza said the Russia-Ukraine War is only one factor battering prices.

"I'm not a believer in the $125 bbl crude forecast but I am a believer in very substantial refining margins for diesel and gasoline this spring and summer," Kloza said. "I sense that diesel and gasoline may trade at least $25 bbl – and perhaps $30 bbl – over crude thanks to refinery downtime, some of which is forever. So with a $100 bbl crude price, that translates into $125-$130 bbl gasoline and diesel at wholesale –about $3 gal to $3.10 gal at terminals."

Low diesel prices were a key contributor to widespread carrier profits in 2020, but that trend reversed for much of 2021. Van fuel surcharges averaged 41 cents per mile last month – up 17 cents year-over-year. It's currently 45 cents per mile, according to DAT’s RateView price-analysis tool, and according to Todd Tranausky, vice president of rail and intermodal at FTR, tensions in Eastern Europe threaten to elevate and sustain fuel prices at high levels and add volatility to global supply chains.

"I think diesel will see sneaky [price] increases," Kloza added, "particularly on the East Coast and West Coast, Rockies and Northwest."

Pump prices for diesel hit a $4.01 gal average Monday "and there is every reason to believe they'll add at least a dime more this week," Kloza said. "That means more fuel surcharges, and higher freights for everything from soup-to-nuts."

Less than 10% of U.S. crude oil imports come from Russia, according to Energy Information Administration data, and the shift to more domestic production seems like a simple fix and quick pricing relief at the pump, but Kloza said it's not that easy.

"The mention of Venezuelan, Saudi [and] Iraqi crude just underscores that light tight shale oil – which we'll see more of in 2022 – isn't the choice of many Gulf Coast or even East Coast and California refineries," he said. "It's one reason why oil independence is a bit of a myth. We can produce 13 million barrels per day soon and bring very heavy sour crude from Canada to refineries, but many refineries were built to run other medium sour or heavy crudes. So we would be importing some crudes even if we raised shale production to 15 million barrels per day."