Tightly managed inventory levels are likely to linger into peak freight season, according to Motive’s first ever Holiday Outlook Report, which looks at the current state of freight and state of retail and was released Sunday at the American Trucking Associations Management Conference and Exhibition in Austin, Texas.

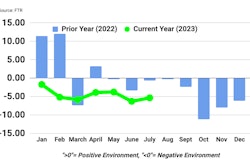

This year has been fraught with reduced consumer demand and an oversupply of capacity, which have shrunk and restrained the market. It’s expected that the trend will continue into the end of the year and in to at least early next year, according to Hamish Woodrow, Motive's head of strategic analytics and author of the report.

Diesel prices, one of carriers' biggest cost centers, saw major fluctuations in 2023. Prices gradually declined from March to June but then surged 18% from July and September. Financial stress, which is measured as the change in payment delays for carriers, saw tight correlation with these swings as Woodrow noted that financial stressors and diesel prices are closely correlated.

"For every 50 cents diesel prices increased in 2023, Motive saw a 30% increase in companies’ financial stress," Woodrow said.

As credit delinquencies overall continue to increase, financial stress impacts smaller carriers especially, most of which have not seen spot rates increase at the same rate as diesel prices and are watching their revenues squeezed at a time when debt options are more limited, Woodrow said.

The number of carriers exiting the market increased in September, moving back toward record levels seen in the second quarter this year and highlighting that the October decreases were likely an anomaly versus signs of a reversing trend. At the same time, new carrier starts saw a 10% drop, also back in line with Q2 and the overall decreases seen in 2023, Woodrow said.

With capacity running higher and supply chains operating leaner, Woodrow said carriers should anticipate that retailers are likely to ramp up inventories closer to when they’re needed for the foreseeable future. Doing so, he added, helps account for potentially slower periods ahead of holiday ramp ups, particularly due to recent decreases in consumer demand.

Not all bad news

One metric that has seen improvement is driver retention, where there has been a 5% improvement from 2022 to 2023, bringing it to 14.9%. Though overall churn remains a challenge, more drivers are staying put, particularly in industries like passenger transport, retail, and warehousing. More drivers staying put, Woodrow said, indicates what they and the wider market desire: more stability, both in their operations and the overall marketplace.

"If we think about the employment market a year ago, there was a lot of jobs out there and retaining employees was pretty tough," Woodrow said.

There's also economic influence in the retention numbers, he added. "This improvement might be due to carriers leaving the market, and hiring slowing down, limiting drivers’ job choices and making them more likely to stay where they are," he said.