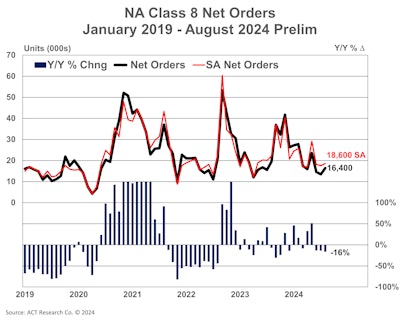

Class 8 preliminary net orders in August totaled 13,400 units, up 2% month-over-month, but down 16% year-over-year, according to FTR Transportation Intelligence. Orders for the past 12 months total 271,000 units.

ACT Research reported that preliminary Class 8 orders in August were 16,400 units, up month-over-month but down 16% year-over-year.

ACT Research

ACT Research

FTR noted that August orders came in below seasonal expectations, as the month-over-month increase from July to August has typically averaged around 20% over the past seven years. The smaller-than-usual rise is likely due to a stagnant truck freight market and order boards for 2024 being full or nearly full.

Year-to-date performance shows orders slightly below replacement demand, averaging 18,735 net orders per month, according to FTR. During the slower April-to-August period, orders have averaged 14,885 per month. Although orders have declined year-over-year for three consecutive months, strong performance earlier in the year has kept 2024 YTD net orders up by 14% compared to the same period last year.

OEMs encountered a mixed market, though conditions remained generally stable, said Dan Moyer, senior analyst of commercial vehicles at FTR. The conventional segment outpaced the vocational sector, accounting for most of the month-over-month improvement.

Even with stagnant freight markets, Moyer said fleets continue to invest in new equipment, though at a more modest rate. “We expect further reductions in backlogs once the final Class 8 market data is released later this month and continued growth in already record-high inventory levels," he said. "Pressure in OEMs to reduce production rates is mounting.”

In contrast, Kenny Vieth, president and senior analyst at ACT, observed that Class 8 orders stayed in line with directional and seasonal expectations in August. “Historically, August is the last month of weak orders before the OEMs open their books to next year’s orders,” he said. Consequently, the month benefits from a significant seasonal adjustment, increasing Class 8 orders by nearly 12% to 18,600 units, compared to nominal levels.

Regarding medium duty, Vieth noted that preliminary orders for Classes 5-7 vehicles saw an improvement in August, increasing by 1,200 units from July to reach 17,300 units. Despite the month-over-month rise, medium-duty net orders were down 16% compared to the same period last year. August traditionally marks stronger demand for Classes 5-7 vehicles, driven by the beginning of the school bus order season.

Net orders for the NA Classes 5-8 in August aligned with an anticipated slowdown, said Vieth. The factors behind these expectations remain consistent: overcapacity in the U.S. tractor market, resulting in historically low profits for for-hire carriers and persistent weakness in freight rates. In the medium-duty market, attention is on the growing financial strain on US consumers, the effects of high interest rates on discretionary spending, and weak demand for RVs.