The freight environment of 2023 was challenging to say the least, and barring some major event it’s not likely to change dramatically this year.

But Avery Vise, vice president of trucking at FTR Transportation Intelligence, said the outlook for 2024 is stable with “very incremental improvement."

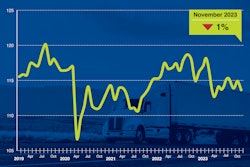

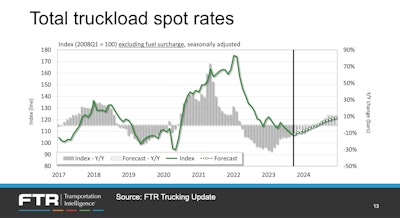

Spot rates saw a strong buildup during the pandemic before collapsing, plummeting about 38% in 2023, and though contract rates haven’t seen the same kind of collapse, they’re down about 12% below the peak at the beginning of 2022.

Vise said FTR is forecasting stagnant utilization into the second quarter of this year with only modest recovery throughout the rest of the year and into 2025, with van segments expected to perform a little better than specialized segments.

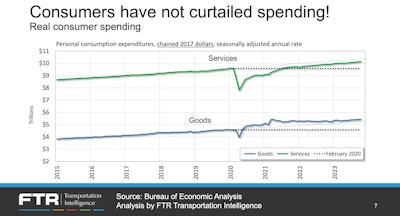

That’s due in large part to lack of growth in manufacturing as well as partly because of consumer spending, said Eric Starks, FTR chairman of the board.

While consumer spending hasn’t fallen off, it has seen only slight growth, and Vise said the economy isn’t likely to see any growth in consumer spending in 2024. But manufacturing impacts freight more than consumer spending anyway, he said. While he said there may be some improvement in manufacturing, no signs are pointing in that direction yet. Starks said there’s more likely to be some downside pressure in manufacturing, which will show up in the freight market as 75% to 80% of the freight market is manufactured goods.

“So from the freight demand side, we're not anticipating much more than holding our own,” Vise said.

He said the stagnant growth in manufacturing has limited FTR’s outlook for LTL going forward, and if LTL remains stagnant for a while, that will keep rates on the higher side.

LTL has been volatile since the failure of Yellow, but Vise said because the freight environment isn’t particularly strong, losing Yellow was more like rationalizing capacity than creating a capacity shortfall. The softness of freight has also culled the heard of some of the many small carriers that came on the scene because of high demand during the pandemic, but he said the market hasn’t lost those carriers nearly to the degree at which they were added.

Though demand has softened, Vise said it isn’t an indicator of a recession.

Starks’ report of the overall economy shows consumer spending remaining steady with a slight growth trajectory in 2024, and payroll growth is coming back, and job growth is solid; inventory correction is underway; and inflation is moving in the right direction.

Starks said FTR anticipated a soft landing following the economic upheaval in the aftermath of the pandemic compared to many people expecting a traditional recession.

“As we move into 2024, the million dollar question is can this soft landing remain? … We think that the Fed could help move that along,” Starks said. “There is a lot of uncertainty, though, within the global markets because when you look at the global conflicts, specifically in Ukraine and Israel and then you have other stuff with China, there's just so much uncertainty out there, and the ability for the Fed specifically to manage that is basically nil.

“They have no ability to do that; they can only be reactionary in that response,” he added. “So right now, all things being equal, we anticipate that we will continue on that track where it's a soft landing.”