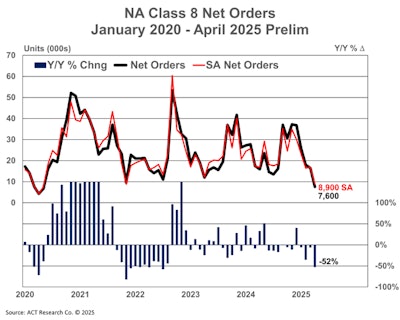

Preliminary Class 8 orders in April declined to 7,400 units, according to FTR Transportation Intelligence – a 54% decline both month-over-month and year-over-year and the lowest monthly total since May 2020 when pandemic-related shutdowns halted demand. The figure falls far short of the seven-year average for April (18,963 units).

FTR reported that April’s downturn was intensified over tariffs, the economy and freight markets, which have diminished fleet investment in Class 8 trucks and tractors.

Net orders for 2025 model year are down 30% year-over-year, FTR noted, while Class 8 retail sales fell 10% year-over-year through March. For the 2025 order season (September 2024 through April 2025), cumulative net orders have dropped 11% year-over-year.

Increasing levels of cancellations in response to growing uncertainty might have contributed to the unusually low order levels this month, FTR said. Both on-highway and vocational truck segments recorded significant month-over-month declines as demand fundamentals continued to weaken. Over the past 12 months, FTR noted that total orders reached 269,772 units.

“New and pending U.S. tariffs and retaliatory tariffs will significantly increase costs for Class 8 trucks, tractors, and related components,” said Dan Moyer, senior analyst, commercial vehicles at FTR.

Combined with a slowing freight market and economic concerns, Moyer said this could further constrain near-term demand in the Class 8 segment. He warned that the resulting volume decline will challenge OEMs and suppliers with production planning difficulties and margin pressures.

“This challenging environment is further complicated by anticipated revisions to the U.S. EPA’s 2027 NOx regulations. Although orders may be approaching their seasonal/cyclical low point, it is unclear how long these depressed demand levels will persist,” Moyer added.

[Related: House revokes California's authority to regulate truck emissions]

ACT Research’s preliminary data reported a slightly higher total of 7,600 orders last month.

“Between the end of the industry’s annual ‘order season’ and the uncertainty surrounding the impact of U.S. economic policy that peaked at the start of the month on ‘Liberation Day,’ April delivered the weakest cumulative medium- and heavy-duty order activity since the beginning of the pandemic when markets were comparably unsettled,” said Ken Vieth, president and senior analyst at ACT Research.

When Classes 5-8 net orders are combined, preliminary net orders for April are expected to reach just 19,200 units, the lowest volume since May 2020, Vieth said.

Regarding medium duty, Vieth noted that the order trend for medium-duty Classes 5-7 vehicles continues to shrink. “ACT’s preliminary look at April NA Classes 5-7 orders put the month’s volume at 11,600 orders, down 41% from last April’s level. Seasonal adjustment provides only modest support.