Tonnage nearly flat in November

ATA index is up 5.9 percent over 2009 period

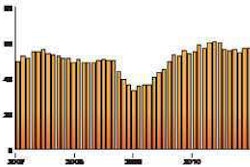

After rising 1.9 percent in September and 0.9 percent in October, the American Trucking Associations’ advance seasonally adjusted For-Hire Truck Tonnage Index was practically flat in Novemeber, slipping 0.1 percent. The latest reduction put the adjusted index at 109.7 in November from 109.9 in October. The nonadjusted index, which represents the change in tonnage actually hauled by the fleets, equaled 108.9 in November, down 3.7 percent from the previous month.

ATA’s Truck Tonnage Index: (Seasonally Adjusted; 2000=100)

ATA’s Truck Tonnage Index: (Seasonally Adjusted; 2000=100)Compared with November 2009, adjusted tonnage climbed 3.9 percent, which was significantly lower than October’s 6 percent year-over-year increase. Year-to-date, tonnage is up 5.9 percent compared with the same period in 2009.

ATA Chief Economist Bob Costello says he is not overly concerned with the small decrease in tonnage during November. “Tonnage increased for two consecutive months in September and October, and I don’t expect volumes to rise every month,” Costello says. “Additionally, the decrease in November is much smaller than the gains during the previous two months.” Costello said he expects truck freight tonnage to grow modestly during the first half of 2011 before accelerating in the later half of the year into 2012.

ATA calculates the tonnage index based on surveys from its membership. The report includes month-to-month and year-over-year results, relevant economic comparisons and key financial indicators. The baseline year is 2000.

IN BRIEF

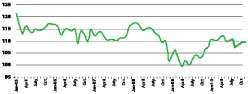

* The Freight Transportation Services Index rose 0.2 percent in October from its September level, the U.S. Department of Transportation’s Bureau of Transportation Statistics reported. The Freight TSI has risen 5.7 percent over the last 17 months, starting in June 2009, after declining 15.3 percent in the previous 10 months beginning in August 2008.

* Transport Capital Partners’ Business Expectation Survey for the fourth quarter of 2010 found that 66 percent of surveyed carriers expect volumes to increase over the next year. That figure is down from a high of 90 percent, which was registered in the second quarter.

* Since August, spot market freight volume has exceeded same-month levels for every year since 2005 – the peak year for truckload freight on the spot market, according to the TransCore North American Freight Index. November was up 72 percent from a year ago, and the expected seasonal decline from October to November was just 2.3 percent, TransCore says.

* TransCore’s Canadian Freight Index rose 37 percent increase in November over the same month in 2009. In addition, volumes were up 2 percent over October even though the U.S. Thanksgiving holiday historically results in a reduction of month-over-month freight volumes.

* Monthly container cargo count at the Port of Long Beach remained strong with a 24.6 percent increase in November compared to the same period a year ago, the port announced. Imports were up 20.2 percent, while exports were up 24.8 percent.

Heavy truck orders surge in November

FTR Associates’ preliminary November data showed that Class 8 truck net orders for all major North American OEMs totaled 26,005 units – a 38 percent increase over October and the highest monthly order level since May 2006. November marked the fourth consecutive month-over-month increase in orders. Net order activity for the six-month period including November equates to an annual rate of 198,510 units. The figure includes the United States, Canada, Mexico and exports.

“We were expecting a normal seasonal increase in orders to a level between 22,000 and 25,000 units,” says Eric Starks, FTR president. “The November number came in slightly above those expectations. This can be chalked up as a win for the industry. The fact that truckers are willing to start ordering equipment is certainly a good sign.”

Starks said the new truck equipment market clearly is in a recovery period, but he is concerned that leasing companies and large fleets led the way. Until smaller and medium-sized fleets jump back into the market, “we will continue to be optimistic, but with a degree of caution.” n