The Ceridian-UCLA Pulse of Commerce Index – a real-time measure of the flow of goods to U.S. factories, retailers and consumers – fell 1.5 percent during the month of February. Coupled with the 0.3 percent loss from January, this latest data eliminates the strong 1.8 percent gain experienced in December 2010. However, February marks the 15th straight month of year-over-year growth, indicating that economic recovery, while fragile, remains under way.

“The PCI performance in the first two months of this year suggests weakness in some parts of the economy,” says Ed Leamer, chief PCI economist and director of the UCLA Anderson Forecast. “Nevertheless, our outlook for 2011 is for continued economic recovery – we expect GDP to grow at the historically ‘normal’ rate of 3 percent, accompanied by a persistent level of high unemployment.”

The Ceridian-UCLA Pulse of Commerce Index is based on real-time diesel fuel consumption data for over-the-road trucking and serves as an indicator of the state and possible future direction of the U.S. economy.

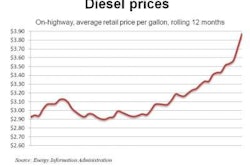

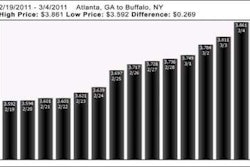

“February’s spike in diesel fuel prices to well over $3 a gallon likely did not drive the weakness in the PCI this month,” says Craig Manson, senior vice president and index expert for Ceridian. “However, if the trend persists, higher prices will likely have an impact in the coming months as consumers are robbed of spending power. The PCI is sensitive to this dynamic and should provide early indications of direction and magnitude as higher fuel prices impact the broader economy.”