Trucking has recovered from the recession much better than the economy at large, but the rebound has slowed in recent months, an economist told attendees of the Commercial Vehicle Outlook Conference in Dallas on Thursday, Aug. 23.

Various domestic and global trends cast doubt on what’s next, said Jim Meil, vice president and chief economist for Eaton Corp. A former professor, Meil rated the state of trucking a B-plus, due largely to a rebound in U.S. manufacturing (B) and nondefense capital spending (A-minus). Other recovering domestic sectors include mining and residential and commercial construction, he said.

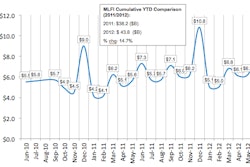

Truck freight should grow 3 percent this year and in 2013, though the gross domestic product will see only 2 percent growth in those years. “That’s the fourth year of lackluster growth after the worst post-war recession,” Meil said.

Meil said that while there was an estimated surplus of 175,000 Class 8 trucks during the recession, now there is a slight shortage, which is good for carriers in terms of keeping their utilization rates and pricing high. Trucking has lost some business to rail intermodal due to the capacity crunch, he said.

Class 8 orders were strong in the first quarter, but “then the bottom dropped out,” Meil said. “Now we’re in the fourth month of a slowdown in orders.” The cause isn’t obvious but might be related to high levels of uncertainty among buyers who likely are concerned about the economic impact of the election and how the fiscal cliff crisis – mandated spending cuts for January 2013 – is handled, he said.

“Nobody really believes all these tax increases or spending cuts will take place,” Meil said. But even if only some do, it will present a “pretty significant fiscal challenge for the economy to overcome.”

Other uncertainty involves problems with the global economy, he said. Europe “is definitely in a recession,” and China, India and Brazil are not living up to expectations of being dominant economic powers.

CVOC was sponsored by Bridgestone, Castrol Heavy Duty lubricants, Chevron, Espar Heater Systems, Freightliner Trucks, Kenworth, Paccar Engine, Peterbilt, TRP and Valvoline.