Several recent reports suggest that any momentum the economy and freight gained in the third quarter likely won’t carry over into the fourth.

On the positive side, the latest Cass Freight Index Report shows freight expenditures rose sharply in September, producing the largest month-to-month increase since March. North American shipment volume also rose for the second month in a row. “For the first time since the recession, we experienced a peak shipping season bump in volume,” says Delcan Corp.’s Rosalyn Wilson, who provides supply chain analysis for Cass. But, she adds: “This increase was driven mostly by a return to growth in the manufacturing sector rather than to stocking up for back-to-school or the holiday season.”

On a month‐to‐month basis, freight shipment volume increased 1.7 percent in August and 2.7 percent in September. For the first time since September, volumes exceeded 2012, barely: up 0.1 percent. However, 2013 shipments were still 3.7 percent below September 2011 volumes, Cass reports.

Freight expenditures for September rose 5.2 percent from August, more than reversing the drop from July to August. For the fourth month in a row, 2013 expenditures were higher than levels in either 2012 or 2011.

Although there has been some upward pressure on spot rates in recent weeks, rates for the most part have been flat to only slightly up. Higher load-to-truck ratios, as well as greater volumes shipped, explain the higher expenditures—not rate increases.

The third quarter saw the greatest year-over-year growth in expenditures, at 4.1 percent, compared to a drop of 0.8 percent in the second quarter and a 0.7 percent rise in the first quarter. As for shipment volumes, the third quarter was the worst this year with a decline of 1.1 percent, following a 1.0 percent decline in the second quarter and a 0.8 percent rise in the first quarter. The first quarter is the only quarter with positive growth for both indicators.

Overall, Wilson says the trucking industry is still in “a precarious balance,” with over 95 percent capacity utilization and an abundance of regulatory and cost pressures that indicate “a looming capacity problem.” The tricky part is forecasting when.

“The economy is growing slowly enough that the tipping point remains just on the horizon,” she says. “Unless there is a sudden surge in freight (which is not expected) or ramped‐up enforcement of FMCSA regulations, trucking capacity will be adequate with little room for expansion.”

Retail, wholesale and manufacturing inventories are at high levels and not moving rapidly. The conclusion? Expect slower growth for the fourth quarter.

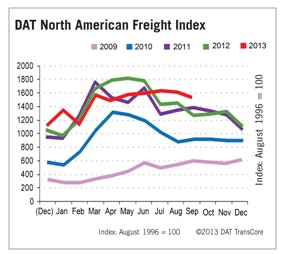

As for the spot market, the shift in seasonal trends drove volumes down 5.3 percent in September, as reported by the DAT North American Freight Index.

Still, spot freight volumes remained stable throughout much of the third quarter, instead of a more typical decline in July that is followed by mixed trends in August and September.

Compared to August, September load availability declined 1.6 percent for vans and 4.6 percent for flatbeds, but increased 1.1 percent for refrigerated trailers.

Third quarter volume was up 13 percent compared to the same period in 2012, but the second quarter lagged Q2 2012 by 16 percent. Year-to-date volume is 1.8 percent higher in 2013.

The spot market report says “a delayed, flattened peak” extended through the third quarter, as severe weather earlier in the year postponed agricultural and construction seasons and related freight movements.

Compared to September 2012, the index increased 22 percent, reaching the highest level recorded for the month of September since the index was established in 1996. Van freight volume rose 12 percent, flatbed loads increased 43 percent and freight designated for reefers added 30 percent.

Spot market rates rose for vans and reefers but declined for flatbeds on both a month-over month and year-over-year basis.

Looking ahead, the National Retail Federation expects sales in the months of November and December to marginally increase 3.9 percent, over 2012’s 3.5 percent holiday season sales growth. The forecast is higher than the 10-year average holiday sales growth of 3.3 percent.

“Our forecast is a realistic look at where we are right now in this economy—balancing continued uncertainty in Washington and an economy that has been teetering on incremental growth for years,” says NRF President and CEO Matthew Shay. “Overall, retailers are optimistic for the 2013 holiday season, hoping political debates over government spending and the debt ceiling do not erase any economic progress we’ve already made.”