Total net orders for Class 8 trucks were 45,978 units in October, up 76 percent year-over-year and the second best in the history of the industry.

The only time on record with more robust activity was March 2006 when fleets logged 52,146 net orders, according to ACT Research. Classes 5-7 net orders were at 22,453, their strongest level since early February 2008.

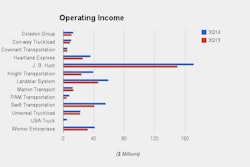

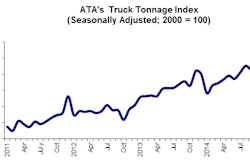

“Conditions relating to freight volumes and rates and truckers’ profits and plans to purchase new equipment remained positive in the third quarter,” says Steve Tam, ACT’s Vice President, Commercial Vehicle Sector. Speaking to the strength in Class 8 order activity, Tam noted, “Through year-to-date October, net orders have been booked at a seasonally adjusted annual rate of 365,800 units.”

Tam says that the performance of the Classes 5-7 segment, while not as spectacular as Class 8, was in keeping with the characteristically measured growth the medium duty market typically exhibits.

“October truck orders drove the market ( up 16 percent month-over-month), while buses (down 43 percent) and RVs (down 21 percent) took a breather,” he says. Classes 5 orders were up 15% year over year and Classes 6-7 orders rose 19 percent.

Don Ake, FTR Vice President of Commercial Vehicles, says orders were driven by several very large fleets placing orders to be built throughout 2015.

“This is the result of the industry operating near full capacity and fleets having confidence that freight growth will remain strong for the entire year in 2015,” he says. “They want to lock in their orders now to guarantee future deliveries. We will be evaluating the second half of the 2015 forecast in light of the confidence reflected in this large order volume.”