Posted rates on the spot market in April didn’t continue the upward trend seen in March, according to the latest data from Truckstop.com, but paid rates — the verified amount paid to carriers after negotiation — climbed in all three segments in the month.

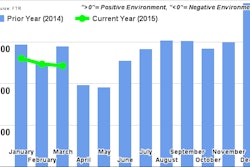

Spot market freight, according to DAT’s monthly Freight Index, fell about 10 percent across the board, however, from March. Compared to last April, freight availability fell 27 percent. Last April, however, saw “extraordinary volume,” DAT says, after winter weather events caused pent-up demand for freight movement. Here’s DAT’s Freight Index chart:

Truckstop.com’s reported rate increases could point to a trend of carriers having leverage in rate negotiations, given the combination of growing freight and tightening capacity.

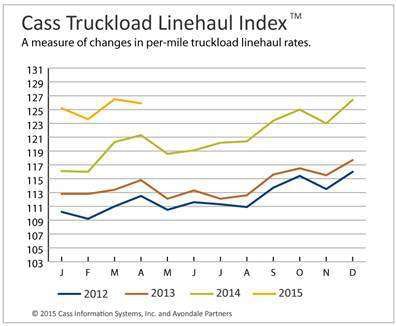

DAT’s Freight Index report also touches on April rates. Though gross rates are down, DAT says, the base portion of rates, the linehaul portion, continues to increase. Lower gross rates are due more to lower fuel surcharges.

Per Truckstop.com, paid reefer rates in the month rose a penny to $2.35. Posted rates in the segment averaged $2.16, meaning on average carriers were able to negotiate rates up nearly 20 cents a mile. Posted rates were flat from March.

Flatbed rates in the month rose 2 cents to $2.26. Posted rates in the month were $2.08, Truckstop.com reports, pointing to another nearly 20-cent difference between post-negotation rates. Posted rates rose 4 cents from March.

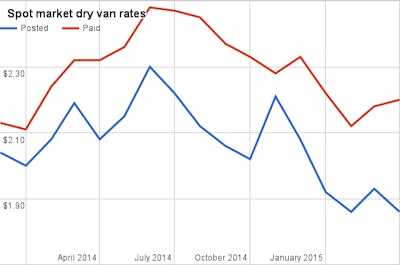

Dry van paid rates rose 2 cents too, to $2.20, while posted rates fell 7 cents to $1.86 — a 34-cent difference between posted and paid rates in the month.

Here are charts for each segment, plotting over time both paid and posted rates. The wider the gap between the two, the stronger the rate market for carriers:

Reefer:

Flatbed:

Dry van: