CCJ Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

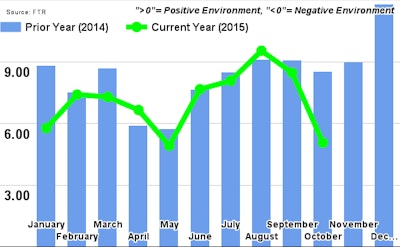

Trucking conditions decline: Conditions for trucking companies, as measured by FTR’s Trucking Conditions Index, dropped significantly in October, signaling a weaker freight market for carriers and less leverage with rates. The drop was in line with expectations.

FTR expects conditions to improve in 2016, however, based on freight growth, tighter capacity and overall economic strength. FTR projects “3 percent or better growth for truck loadings in 2016” and a stronger year overall than 2015.

“We expect conditions to improve as we move through the year as the market further prepares for tight truck capacity when the HOS, ELD, and speed governor rules are implemented over the next two years,” says FTR’s Jonathan Starks. “The main risk right now is the weakness in manufacturing and the high inventory levels. The inventory situation needs to be corrected before we are likely to get a sizable burst of manufacturing activity. Look for that to happen early in 2016.”

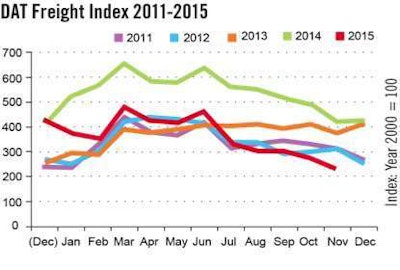

Van freight fell 2.9 percent from October, flatbed 39 percent and reefer 9.1 percent, DAT says. Rates also fell in all three major truckload segments.

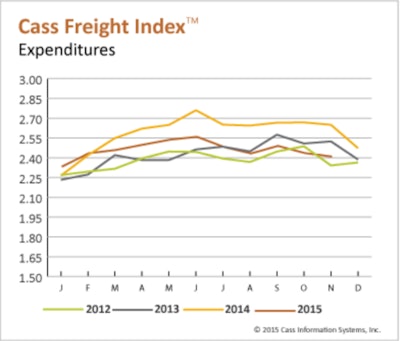

Compared to last November, shipments were down 5 percent and expenditures were down 9 percent.

Cass’ indices encompass both rail and truckload, however, and Cass attributes much of the downward pressure to falling rail freight, not truck freight.