TransVix and DAT Solutions announced a strategic alliance to create a Trucking Futures Exchange to list and trade contracts based on trucking line haul rates.

The TransVix Exchange will list contracts that are financially settled using DAT’s data for major freight lanes in the U.S.

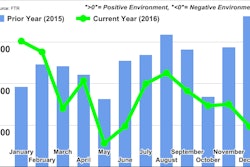

TransVix says it is focused on addressing volatility in line haul freight rates, where spot prices can swing as high as 40 percent in a single week on some major lanes. Volatility of truck capacity can be driven by a host of market conditions such as weather, seasonality, regulations and macroeconomics.

Brokers, carriers, and shippers all face the same challenges when it comes to volatile spot rates and are exposed to market conditions without viable hedging options to manage price risk.

TransVix is partnering with DAT to provide participants with risk-management tools to hedge their freight lane exposure. DAT data will be used to help develop TransVix trucking futures, which will allow market participants to normalize these price fluctuations.

“DAT is the truckload pricing index standard for the North American trucking market, and it makes perfect sense for us to partner with them” said Craig Fuller, TransVix CEO.

“We have observed supply and demand fluctuations and periods of significant truckload capacity constraint over a period of years, and recognize the financial risk that our customers face,” said Don Thornton, senior vice president of sales & marketing at DAT.