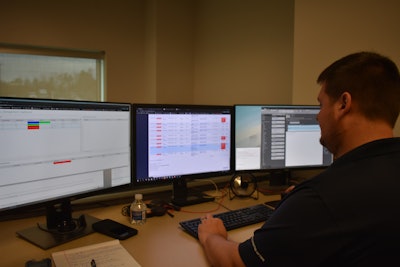

OEMs use telematics to remotely program trucks and engines. Bobby Weisneck, supervises the remote programming and diagnostics team in Volvo’s Uptime Center.

OEMs use telematics to remotely program trucks and engines. Bobby Weisneck, supervises the remote programming and diagnostics team in Volvo’s Uptime Center.Fleets often install multiple devices on vehicles. Each device may have separate cellular data subscriptions to power applications such as electronic logging devices (ELDs), tire pressure monitoring systems (TPMS) and video event recorders.

Truck manufacturers also install telematics systems at the factory for “connected vehicle” applications like remote diagnostics and over-the-air vehicle and engine programming.

In terms of cellular connectivity, “there is a lot of redundancy,” says Nick Forte, vice president of maintenance and equipment at Hirschbach Motor Lines, a 2,000-truck carrier based in Dubuque, Iowa.

Hirschbach has three cellular data connections for each vehicle. One is for the tablets that run ELD and other mobile applications from Transflo. The Transflo platform gets data from another connected device, Geotab, that plugs into the vehicle data bus.

The third connected device is the OEM factory installed telematics systems. Ideally, Forte would like to see data and subscriptions for all its mobile and connected vehicle technologies consolidated through a single vehicle gateway.

The OEM telematics systems could be the gateway, but currently most OEMs are using their telematics systems only to transmit data to their own servers in the cloud for remote diagnostics, remote programming of vehicle and engines and to gather operating data for product development.

Could factory-installed OEM telematics devices eliminate the redundancy of hardware and cellular data subscriptions for fleets? It’s possible, but “I don’t think OEMs are there today,” says Doug Schrier, vice president of product and innovation at Transflo. OEMs are working on it, but technology providers today “have different use cases and a lot of times it is easier to put different cellular connectivity points in there to handle those use cases,” he explains.

The different use cases for fleets include tablets with cellular connections for drivers to go outside the truck and “do everything they need to do, from a DVIR to trip planning within the truck stop to training within the corporate office,” Schrier says. When a driver is outside the cab, fleets want separate cellular connections for their tablets, ELD units and vehicle telematics system to be able to track their assets.

Some shared connections between OEM and aftermarket telematics and ELD systems have been established and Schrier expects to see, in the near future, “an open device” in vehicles that technology suppliers like Transflo will be able to connect to. “As long as a fleet [and OEM] gives you access you can use that data to better serve their fleet,” Schrier continues. “And if you can reduce costs along the way you’re going to do it.”

Neil Cawse, chief executive officer of Geotab, believes within the next five years fleets will opt-out of installing telematics devices because the connected vehicles of OEMs will come standard with a free basic management platform.

Neil Cawse, chief executive officer of Geotab, believes within the next five years fleets will opt-out of installing telematics devices because the connected vehicles of OEMs will come standard with a free basic management platform.Instead of installing ELD and telematics devices after they purchase vehicles, more fleets will be using OEM-installed telematics devices as a gateway to a marketplace of software-as-a-service applications.

Some OEMs already send their telematics data to public servers in the cloud, such as from AWS or Azure, and have integrations with various third-party ELD and telematics providers.

For fleets, activating their OEM’s vehicle gateway service could be as easy as going to the online portal of their preferred fleet management provider and entering a VIN number, says Brian Mulshine, director of customer experience at Navistar.

Once this step is done, the pre-built data integrations between servers in the cloud for their truck OEM and mobile fleet management provider could make the telematics data instantly available to the applications that fleets and drivers use.

“This will require investments from both the OEM and the telematics service provider but is something more and more fleets are asking for,” Mulshine says.

Daniel Levy, who leads fleet telematics provider Verizon Connect’s OEM partnerships, says the predominant model for OEMs, particularly in the light and medium-duty markets, is to create a marketplace for fleet management solutions using data from factory-installed telematics systems. “Those that are not aligned with that model now are moving in that direction,” he says.

Verizon Connect has OEM partnerships with Iveco, Ford and Ram Trucks.

In addition to consolidating hardware and wireless costs, fleets could benefit from OEM telematics being covered in their vehicle warranties and serviced by their OEM dealer networks, Mulshine says.

Currently, Volvo Trucks and Mack Trucks have integrations that feed data captured by their factory-installed telematics systems to ELD and fleet management platforms from Geotab and Omnitracs that eliminate the need for fleets to install hardware.

Geotab also integrates with embedded telematics systems in light and medium-duty vehicles from GM and Ford.

Freightliner installs telematics devices from Zonar but has not made any announcements to make the data available to third-party telematics devices. Likewise, Kenworth and Peterbilt have a partnership with Trimble and have not announced plans to do this.

The change to using factory-installed telematics devices is a big departure from the transportation industry’s practice of installing, uninstalling and reusing telematics devices on vehicles throughout their lifecycle.

The evolution of mobile operating systems has ushered in a new era where fleets are replacing onboard computers far more frequently than they have in the past, says Ray Greer, chief executive of Omnitracs. Greer says the company is working to integrate with more OEM-installed telematics systems, and its new Omnitracs One platform works on any mobile device. He does not anticipate that Omnitracs will be getting out of the hardware business anytime soon, however.

Trucks go through several owners before they reach their end of life. While the original buyer of a new vehicle will not install telematics hardware in the future, the used truck buyer will install third-party hardware, he predicts, after the OEM’s telematics platform and vehicle goes outside warranty.

“Lifecycle management will always be a challenge for the industry,” Greer says. “We will always have hardware. I don’t see a world where we won’t.”