Cost per mechanical repair (excluding tires and tow) topped $500 for the second consecutive quarter, and reached the highest amount in Q3 since FleetNet started its benchmarking report in late 2017.

Cost per mechanical repair (excluding tires and tow) topped $500 for the second consecutive quarter, and reached the highest amount in Q3 since FleetNet started its benchmarking report in late 2017.Truck maintenance kicking off the second half of 2020 fell in line with what could be the anthem for all of last year – a little bit of good mixed with a little bit more bad.

Motor carriers logged 34,629 miles between unscheduled roadside repairs in the third quarter 2020, according to the most recent quarterly benchmarking report compiled by FleetNet America – a slight dip from Q2 but a decrease of more than 5,000 miles from Q3 2019. The truckload segment saw the biggest segment gain – logging 23,223 miles between roadside repairs – equaling the distance posted in 2Q 2020 and doubling mileage from Q3 2019.

Best-in-class carriers in the truckload segment logged 54% more miles than the fleet average, hitting 35,906 miles between events. The top carrier in the LTL segment beat the segment average (47,622) by 34%. The top tank carrier more than doubled the rest of the segment, hitting 43,859 miles compared to a 20,115 average.

Cost per mechanical repair (excluding tires and tow) topped $500 for the second consecutive quarter, and reached the highest amount in Q3 since FleetNet started its benchmarking report in late 2017. Tires and tows are excluded from repair cost data due to significant rate and cost variability among carriers.

Following a dip of $3 from Q4 2019 to Q1 2020, the cost of mechanical repair has increased each quarter this year, and significantly so – jumping 21% from Q1 to Q3 last year. Average miles between breakdown improved only 7% in the same time, setting up the potential reversal of repair and maintenance costs, which according to the latest Operational Costs report from the American Transportation Research Institute, fell from 17.1 cents per mile to 14.3 cents per mile in 2019.

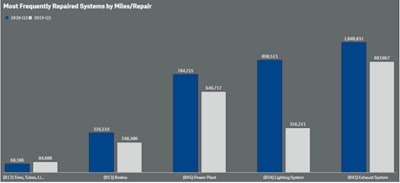

The five most frequently repaired VMRS (vehicle maintenance reporting standards) systems continued to consolidate in FleetNet’s most recent report, with the top five systems accounting f0r 72% of all roadside repairs experienced by participating fleets.

Carriers who participated in the FleetNet America report enjoyed year-over-year improvements in the miles between repairs for four of the top five VMRS systems during Q3, with 034-lighting seeing the greatest gain (774% improvement) versus the same quarter 2019 in the truckload segment.

After declining for the past four quarters, the average cost of a mechanical repair in the truckload segment jumped more than 18% to $411. The most expensive repairs among the truckload cohort were 023-clutch system ($1,000), 042-cooling system ($704) and 031-charging system ($676).

LTL carriers were hit the hardest ($642) by spiraling repair costs, as two of the segment’s top five VMRS system repairs as tracked by FleetNet – the power plant ($734) and the cranking system ($545) – carried significantly higher costs per repair.

Tank fleets held steady with miles between breakdowns, having averaged about 22,000 miles per event for the first three quarters of 2020, and in Q3 reached its lowest cost per mechanical repair ($420) since the reports inception.