After a prolonged period of challenges, the industry is showing signs of promise, according to Orderful’s 2025 Carrier Performance Trends report. However, the volatility of specialized freight markets and seasonal fluctuations continue to pose hurdles for carriers and shippers alike.

Orderful analyzed anonymized data from more than 500 million EDI transactions processed through its cloud EDI platform as of Oct. 30, 2024. The research team tracked year-over-year and month-over-month changes across different equipment types while measuring carrier concentration, market share dynamics, and network structure patterns.

The report noted that the trucking industry has been climbing out of its downturn, with LTL performance stabilizing and showing signs of a “new normal.” However, not all segments are rebounding at the same pace. Some are recovering fasting than others, making it essential for carriers and shippers to stay agile and adjust strategies to shifting demand patterns.

Orderful CEO Erik Kiser asserted the significance of adaptability in the current market. Carriers showing the strongest resilience are those balancing specialized expertise with operational flexibility, he said, adding that these carriers leverage technology to respond to seasonal volatility and utilize core competencies in their market segments.

The balance between specialization and adaptability will distinguish logistics leaders in the industry, he noted.

Seasonal trends are becoming more predictable

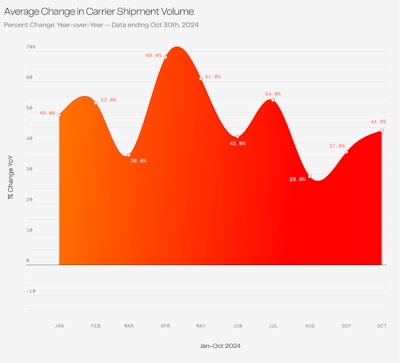

Seasonal trends are also becoming more easier to anticipate. Based on the report's volume performance analysis, while the industry has struggled through contraction and historically low rates, year-over-year growth figures (reaching peaks of 68%) signal a potential turning point in the market.

Month-over-month data also pointed nuanced patterns of market adaption. “The sharp contrast between summer lows (-13.6% in June) and the October rebound (+11.3%) demonstrates how seasonal factors continue to influence the market’s trajectory,” the report stated.

The fluctuations highlight that the industry isn’t following a simple upward path but rather adapting to both seasonal patterns and structural changes, indicating that carriers are learning to navigate these cycles more effectively.

Market concentration is reshaping the industry

The report analyzed how different trucking segments are seeing increased concentration.

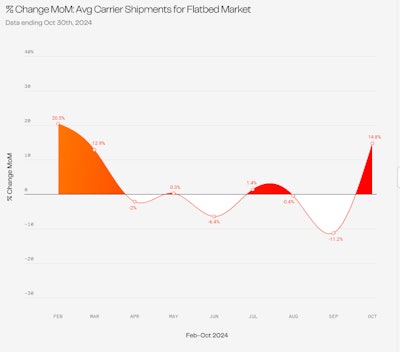

Flatbed carriers operate in a structured but rigid market, with 91% of the segment relying on standard configurations.

Data indicated month-over-month fluctuations, with significant spikes in in February (+20.5%) and October (+14. 8%), bookending a year of modest gains and sharp declines, including a notable drop in September (-11 .2%). “These patterns reflect both seasonal demand cycles and the limitations of a highly concentrated market," the report stated.

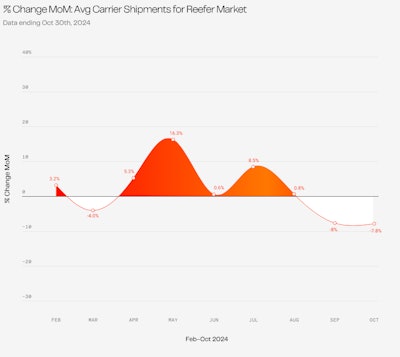

Meanwhile, reefer markets show relative stability amid shifting demand. Monthly data reveals strong performance in spring and early summer (peaking at 16.3% growth in May), followed by a gradual decline into fall, reflecting both seasonal patterns and broader market adjustment.

This presented a double-edged sword, the report pointed out: on one hand, the high barriers to entry and specialized expertise helped reefer carriers maintain stability through market shifts. However, the same concentration may limit flexibility as the market evolves. The recent downward trend (-7.8% in October) indicated that even specialized segments must adapt to changing market conditions.

The report stressed the importance of carrier relationships as key competitive advantage, especially in tightly concentrated markets. As the industry continues to recover, businesses that prioritize long-term partnerships with carriers will gain a strategic edge.