Despite a decline in freight volumes, shipper spending increased for the second for the second consecutive quarter, reversing the fleeting improvement seen in the second quarter.

According to a U.S. Bank Freight Payment Index report, national shipment volumes fell 2.9% from the previous quarter, while shipper spending rose 2%. On a year-over-year comparison, shipment volumes declined 10.7%, while spending remained 1.7% below year-ago levels.

“Shippers paid more to move less freight in the third quarter — a clear sign that industry capacity is exiting. While higher fuel played a role, it doesn’t fully explain the increase in spending,” said Bobby Holland, U.S. Bank director of freight business analytics.

The report pointed to several headwinds, as shipments have declined more than 40% since 2020, apart from Q2 2025. The goods economy lost momentum during the summer and into early fall. Tariffs remain a significant factor for the freight landscape, with manufacturing bearing the brunt of the impact.

The U.S. accounts for the second largest manufacturing economy, producing over 15% of global manufacturing output, trailing only China.

“Almost half of imports are unfinished goods vital for manufacturing, so tariffs are hurting factory output. Most manufacturing indicators show little growth or even a decline, and manufacturing remains a major source of freight for trucking,” the report said.

The housing construction also decelerated in the third quarter, further decreasing freight volumes. Neither mortgage rates nor the Federal Reserve’s rate cut prevented quarter-over-quarter and year-over-year contractions in single-family home construction.

Consumer spending on travel declined sharply, but consumers did not reallocate those funds towards goods purchases. Instead, overall discretionary spending declined.

“This is an indication that household spending is slowing,” it said, resulting in soft freight volumes and cost pressures that continue to squeeze carriers.

“The impact of fleet exits is showing up in pricing, pushing rates higher even as volumes remain soft,” Holland said.

Besides fleet exits, the report added that it saw further reductions in industry capacity due to decreased equipment availability and regulatory adjustments affecting drivers.

[Related: Trucking market recovery will be driven by 'necessary evil,' ATA's economist says]

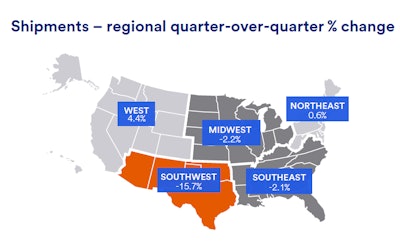

Northeast and West buck national downturn

Freight volumes and spending in Q3 reflected market pressures, with national declines offset by resilience in the Northeast and West.

The West region saw the strongest performance, with shipments rising 4.4% quarter over quarter and 4.6% year over year. Spending climbed 8% sequentially and 6.8% compared to the prior year. Freight volumes in the West rose for the third straight quarter, supported by port activity.

The Southwest saw significant headwinds, with the largest sequential shipment decline among all regions at 15.7%, with year-over-year volumes plummeting 32.8%. However, spending showed resilience, edging up 0.3% from the previous quarter and gaining 3.8% year over year. The Southwest saw the largest sequential shipment decline among other regions, with home construction and labor markets seeing a slowdown.

Additionally, trade policies and economic conditions have also caused a contraction in the number of inbound trucks from Mexico to the region.

“During July and August, inbound truck volumes decreased by 1.2% compared to the second quarter monthly average. In August, the reduction was larger, with a drop of more than 3%, equating to over 15,000 loads. At Laredo, Texas, volumes declined by 6.1% in August compared to the previous year,” the report noted.

Midwest activity weakened across both metrics, with shipments falling 2.2% quarter over quarter and 11.5% year over year. Spending declined 1.4% sequentially and 6.3% compared to the same period last year. Freight activity in the region declined, impacted by soft consumer spending.

The region’s proximity to Canada also shaped freight dynamics, as fewer Canadian shoppers and tourists have crossed the border. Freight truck crossings between the region and Canada remained stable through July and August compared to the previous quarter, though they remained about 6% behind the prior-year pace.

The Northeast stood out amongst all regions in growth momentum, with shipments increasing 0.6% from the prior quarter and 6.3% year over year. Spending performance was also strong, rising 5% sequentially and 11.7% annually. It led all regions in year-over-year shipment and spending growth, driven by manufacturing and retail sales. Housing market activity was also mixed.

“While existing home sales slightly improved, home construction was down significantly during July and August,” the report said.

The Southeast saw modest declines, with shipments down 2.1% quarter over quarter and 10% year over year. Spending rose 1.6% on a quarterly basis but remained 8.5% below prior-year levels. Soft manufacturing, consumer activity and reduced tourism impacted freight activity in the region.