ATA Chief Economist Bob Costello noted that tonnage has flattened out, on average, over the last six to nine months.

ATA Chief Economist Bob Costello noted that tonnage has flattened out, on average, over the last six to nine months.

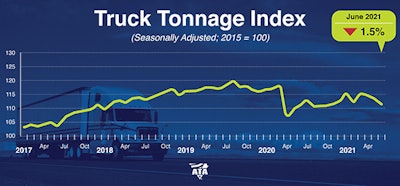

ATA Chief Economist Bob Costello noted that tonnage has flattened out, on average, over the last six to nine months, adding that "the good news is that it remains slightly above 2020 levels."

“Supply chain issues are likely putting some downward pressure on tonnage,” he said. “But it is also likely that tonnage isn’t growing as much as it could because of industry-specific supply constraints. This index is dominated by contract freight, and the for-hire truckload carriers have seen their tractor counts fall because they are having difficulty finding qualified drivers. It is difficult to move more tonnage with less equipment, which is why we are seeing strong volumes in the spot market as shippers scramble to get loads moved.”

May’s reading was revised down slightly to -1% from ATA's estimation released June 22. Compared to June 2020, the SA index rose 0.5%, which was preceded by a 3.3% year-over-year increase in May. Year-to-date, compared with the same six months in 2020, tonnage is up 0.3%. The not seasonally adjusted index, which represents the change in tonnage actually hauled by the fleets before any seasonal adjustment, equaled 116.2 in June, 2.4% above the May level (113.4).

Spot market softening but still above $3/mile

ATA’s For-Hire Truck Tonnage Index heavily weights contract freight as opposed to spot market freight, but data from Truckstop.com and FTR Transportation Intelligence for the week ended July 16 suggest that after more than a year of stress, spot volumes in dry van and refrigerated freight might finally be starting to return to normal.

Volumes can be volatile surrounding holiday weeks but, generally, load availability in a post-holiday week will recover at least a portion of the volume lost during the holiday week. However, total load postings in the Truckstop.com system fell 5.6%, and the declines in dry van and refrigerated were similar to those during the week that included the Independence Day holiday. Flatbed volume was up 3.6%, which is not a strong figure either given that the prior week had included an observed federal holiday. However, because the actual holiday fell on a weekend, expected impacts on the market both heading into and out of the holiday might be distorted.

Although the lack of a partial recovery from the holiday week was a surprise, seasonal weakness is typically expected after June. The market saw no seasonality in the rebound last year. Truckstop.com noted that upward pressure is unlikely comparable to last year, but that the economy will see additional stimulus in the form of monthly advance child tax credit payments that began last week. Meanwhile, many supply chains are still constrained, and capacity remains tight for a variety of reasons. For example, one major rail carrier has temporarily suspended inbound intermodal shipments from most West Coast ports. All this disruption is supporting spot market volumes even if they aren’t staying at the stratospheric levels that have been experienced over the last year.

Although the tax credits and other disruptions might still lead to another boost, pricing in the spot market might have peaked until yearend holiday moves. Rates have declined in five of the last seven weeks. The broker-posted rate per mile excluding fuel surcharges fell less than 2 cents last week and remains about 36% above the same 2020 week.

Total truck postings edged up 0.3%, although the increase was principally focused in flatbed. The Market Demand Index fell to 149.4, which is the lowest level since early February.

Load volumes decreased 13% week-over-week, even though the daily high point for last week was 1,014,000. Capacity remained constrained at 32.01 week-over-week, according to Truckstop.com (the 5-year average is 88.00).

Rates fell 1 cent to $3.06/mile (46 weeks above $2.40. The 5 year average is $2.28). Van rates, according to Truckstop.com, decreased a penny to $2.72; flatbed slid 1 cent to $3.12; and reefer decreased 5 cents to $3.20.

Outbound tender rejections saw a small decrease to 23.12 from 24.95, meaning almost one of every four loads are being rejected.