FTR's Avery Vise, vice president of trucking, and Eric Starks, chairman of the board, gave an update on the company's 2004 outlook for freight during a webinar Thursday.

It started near the bottom.

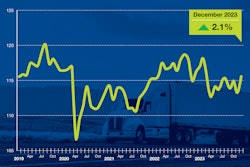

Dry van spot rates have found their bottom, Vise says, as have refrigerated spot rates. Flatbed spot rates may have yet to hit bottom, Vise says. But spot isn't the entire freight market.

"A lot of the weakness we saw in 2023 was in areas that probably a lot of you don't think a lot about," Vise says, such as short haul and heavy haul. Flatbed "didn't break any records, either," he says. Active truck utilization bottomed out over the summer, Vise says, and remains in line with 2019, pre-pandemic levels.

[RELATED: MacKay & Company provides detailed 2024 aftermarket outlook]

Contract rates haven't yet bottomed out, Vise says, as they move more slowly.

"We are running down at this point," Vise says. "Still in the neighborhood of 8-10% higher than we were at the peak of the last cycle."

Vise and Starks also went over employment numbers, which included a downward revision from the Bureau of Labor Statistics.

"For trucking, that meant that December's seasonally adjusted payroll employment is lower than we thought previously," Vise says, and forecast numbers have also ticked down accordingly. "Employment is clearly declining, but I would not say it's doing so rapidly, given all the talk of a freight recession."

[RELATED: See Trucks, Parts, Service's industry survey on what readers see on the horizon in 2024]

Local general freight trucking jobs took the biggest hit, Vise says, with a downward revision of 16,600 jobs or a drop of more than 5% over previous numbers. But don't be fooled.

"That segment is still up 3.5% year-over-year and up 13% over February 2020," Vise says.

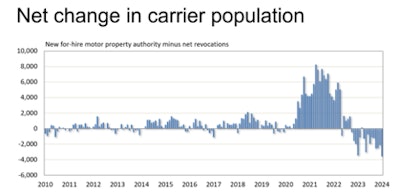

Vise and Starks also reviewed net revocations of trucking authority and compared those numbers to new for-hire trucking companies. Numbers are down, they say, but they're down from record highs.

"We still have something on the order of 85, 90,000 more for-hire trucking operations than we did before the pandemic," Vise says. Most of the carriers are small, he says, with only one to two trucks.

Vise says these carriers are managing to hold on with pandemic money lingering in the marketplace. Small carriers have been using that to offset the declining number of jobs.

"One answer is that if you can survive today," with bottomed out rates and declining diesel prices, Vise says, "There's no particular reason for you to go out of business."

[RELATED: Bleak fourth quarter creates more consternation for dealers, aftermarket]

These smaller carriers will potentially face issues with their equipment cycle, Vise says. They're going to need to replace trucks soon or the maintenance costs will become problematic. Or they may be underwater on their trucks because they bought them at market highs in 2021-2022.

"My suspicion is that the latter group, a lot of those are among the ones that have already gone out of business," Vise says.

The loadings outlook is still down slightly relative to last year, Vise says, with a lack of positive growth until very late 2024.

"We're still seeing kind of a slow flow of infrastructure spending," Vise says. "That could definitely have a positive effect on flatbed and specialized bulk dump."

FTR also sees more active truck utilization, again rising slowly from its bottom in 2023, as will total truckload spot rates. Contract rates are close to the bottom, Vise says, and won't see positive growth year-over-year until 2025, with steady growth thereafter. LTL will also see slow growth, up around 3.4%. The demand side is still weak, Vise says, and a lot of the improvements have been because Yellow is no longer in the marketplace.

Starks and Vise also considered the coming EPA emissions mandate. Unfortunately, they say, more expensive trucks that will meet the regulations won't come with higher rates to offset the costs.

"The cycle is what the cycle is," Vise says. "It's supply and demand."