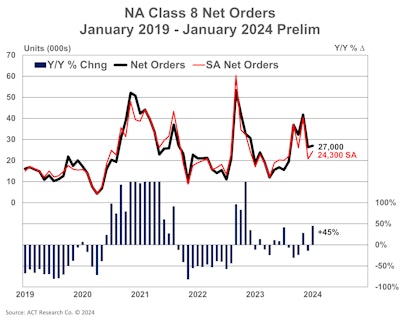

Truck orders maintained momentum in January, gaining a slight bump from December, according to ACT Research and FTR.

ACT Research reported that North American Class 8 truck orders for January came in at 27,000 units, up 600 units from December. ACT preliminary data showed orders also increased 45% from a year ago.

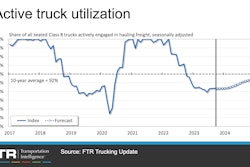

FTR’s data indicated that Class 8 preliminary net orders came in at 26,400 units, up 2% from December and up 35% year-over-year. It estimated that Class 8 orders over the past three months are running at an annualized rate of 354,000 units. The annualized rate over the past six months has been 327,000 units. Orders for the previous 12 months equaled 259,000 units, FTR noted.

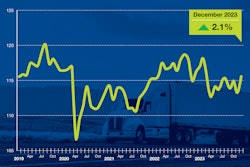

NA Class 8 Net Orders

NA Class 8 Net Orders

“Weak freight and carrier profitability fundamentals, and large carriers guiding to lower capex in 2024, would imply some pressure in the North America Class 8 market’s largest segment – U.S. tractor," said ACT President and Senior Analyst Kenny Vieth.

Though ACT still doesn’t have the underlying details for January orders, Vieth said demand for Class 8 continuing at high levels at the start of the year indicates that over-the-road U.S. truckers are still buying.

FTR Board Chairman Eric Starks said build slots continue to be filled at a healthy rate. He explained that January orders were coming in at a rate that was comparable to the previous month, indicating that the market is “still performing at a high level historically.” OEMs experienced a mixed market in January, with some seeing increases and others seeing decreases in orders.

Despite uncertainty in the freight market, fleets continue to be willing to order new equipment, Starks added.

[RELATED: Truck, trailer orders indicate slowest December since before pandemic began]

“Order levels were above the historical average and above seasonal trends, although we still expect 2024 activity to reflect replacement demand,” he said.

Seasonal adjustments pushed ACT’s January estimate up 17% from December, increasing January’s Class 8 intake to 24,300 units (292,000 SAR). This is marked as the third-largest seasonal factor of the year.

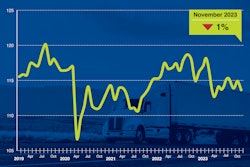

NA Classes 5-7 Net Orders

NA Classes 5-7 Net Orders

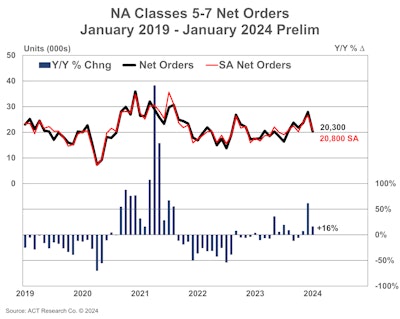

Looking into the medium-duty space, Vieth said Classes 5-7 net orders were 20,300 units in December, up 16% year-over-year, according to ACT’s State of the Industry: Classes 5-8 Vehicles report.

“Unlike Class 8, medium-duty seasonality is modestly positive in January, boosting the seasonally adjusted over tally to 20,800 units, down 21% m/m from a tough best-month-of-2023 December comp,” Vieth added.