The Federal Reserve is back to cutting rather than raising interest rates, used-truck pricing's in relative normalcy and fuel prices have moderated considerably. These three things, among others, had ATBS Vice President Mike Hosted optimistic on at least one front for owner-operators during his presentation Wednesday on the business services firm's mid-year annual operating analysis derived from clients' anonymized data.

Hosted was optimistic, that is, about a measure of cost certainty truck owners can now hold fast to, looking out at prospects of another six months to a year of freight-rate stagnation before meaningful improvement.

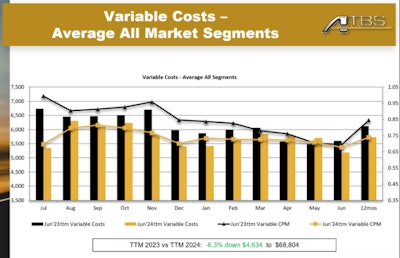

"We're seeing stability for the first in a very long time" as regards costs, he said. Owner-operators' average fixed costs in his analysis' 12-month lookback (July-June) were up 3% year-over-year, yet variable costs (fuel, maintenance and the like) were down, falling by a greater measure -- 6.3%.

Variable-cost reductions over the last 12 months led to an overall cost drop for the year, Mike Hosted noted. As with other similarly-structured graphs shown in this story from Hosted's Wednesday presentation, the bars (lump-sum) and lines (per-mile) on the chart offer monthly comparisons between time periods July 2023-June 2024 (the light-colored bars/lines) and July 2022-June 2023.All charts courtesy ATBS

Variable-cost reductions over the last 12 months led to an overall cost drop for the year, Mike Hosted noted. As with other similarly-structured graphs shown in this story from Hosted's Wednesday presentation, the bars (lump-sum) and lines (per-mile) on the chart offer monthly comparisons between time periods July 2023-June 2024 (the light-colored bars/lines) and July 2022-June 2023.All charts courtesy ATBS

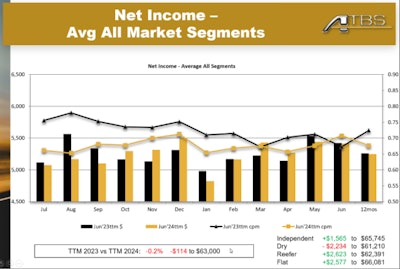

Overall, for the first time in quite a while, costs were down 2.2% on the whole, in part enabling owner-operators among ATBS clients to post the first year-over-year average income gains seen in more than two years.

That was case for three segments analyzed, anyway -- leased refrigerated and flatbed haulers, and independents, as shown at the bottom right of the chart below. On the whole for the analyzed period, owner-operator average income was more or less flat, down just 0.2%, noted Hosted, with rising segments drug down by losses for leased dry van owner-operators.

Year-over-year comparisons turned favorable this year in March, and with the exception of May holding generally in line through June. Note, however, the bigger per-mile difference over the most recent 12 months. Owner-ops have run more miles to get to the same income figure for the year: miles were up nearly 7% versus the prior 12-month period to about 93K on average.

Year-over-year comparisons turned favorable this year in March, and with the exception of May holding generally in line through June. Note, however, the bigger per-mile difference over the most recent 12 months. Owner-ops have run more miles to get to the same income figure for the year: miles were up nearly 7% versus the prior 12-month period to about 93K on average.

The leased flatbedders among ATBS clients seeing positive gains in recent months tells him better times are coming with more construction and manufacturing. "Roads, bridges, buildings -- part of it is that infrastructure spending bill," he noted, passed in 2021 but with projects it funded increasingly coming online.

"We've come a long way down from the peak" for income, when in 2021 owner-operators averaged more than $70K net income, he said, and there's no significant upward trend yet. But for those owner-operators still standing, focusing closely on containing costs and taking advantage of any and all opportunities to generate more revenue, "we're on the verge of that happening. Keep it up and the hard work will pay off."

[Related: Roads through the dark clouds of a very tough market: Owner-operator limitations, possibilities]

How do owner-operators and small fleets survive and thrive in tough economic times? Find out in this on-demand webinar.

Register today and watch the on-demand webinar from owner-operators and small fleets as we discuss how they prepared during the good times to weather the storms.

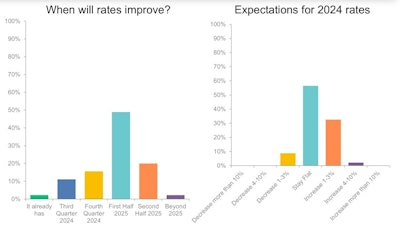

Surveying fleets among ATBS partner carriers -- all of whom work with a lot of owner-operators -- Hosted found some possible answers to the top question owners have been asking. When will the market turn to the positive for truckers?

"It's been a long time that we’ve been waiting on that," he noted, and most fleets have said they're "expecting things to stay level" from a rates perspective. Even two and more years into the long fall in contract rates, "shippers are saying, 'we need lower rates,'" but at this point big contracting carriers "are telling us they're holding the line -- 'We can't be profitable if we keep going lower.'"

DAT recently reported that contract rates have continued to lose ground past the June end of ATBS's analysis, though.

- Van contract rate for August: $2.40/mile, down 3 cents from July

- Reefer : $2.74/mile, down 7 cents

- Flatbed: $3.08/mile, down 3 cents

Monthly average contract rates for all three of those segments, furthermore, have been year-over-year negative since August of 2022, with protracted pricing challenges all around. (DAT noted approximately 85% of all truckload freight moves under contract.)

Spot markets haven't fared any better, bouncing along the bottom of the trough. Most carriers ATBS spoke to recently, Hosted said, believe every presidential election season leads to freight cycle instability, with consumer pessimism growing as well with uncertainty about the future. "Uncertainty, generally, makes freight rates go down" as economic activity suffers, Hosted noted. "Once the election cycle is over," whoever wins, he and many owners he's spoken to expect "more stability and rates improvement next year."

[Related: Will you vote? Resources on registration, early and absentee voting, more]

About half of fleets among ATBS partners surveyed expected rates to remain flat through 2024 (right) and to experience improvement by some measure in the first half of 2025.

About half of fleets among ATBS partners surveyed expected rates to remain flat through 2024 (right) and to experience improvement by some measure in the first half of 2025.

Shippers, he added, seem to have similar expectations, as many fleets reported their customers attempting to "secure excess capacity earlier and lock in current rates longer. That’s a good sign that these shippers believe rates will have to go up in the future." As noted above, though, more carriers are resisting that, saying "no, we want to go higher," he said.

There's danger there in some ways, given Hosted feels the number of motor carriers competing for the freight that's available remains elevated today in shippers' favor, though approaching equilibrium. "We're seeing carrier failures," he noted, yet a "percentage of these [one-truck and other small carriers] have just moved back to leasing to another motor carrier with better contract rates. We’ve seen quite a bit of that amongst our clients, and the fleets we work with are telling us the same thing."

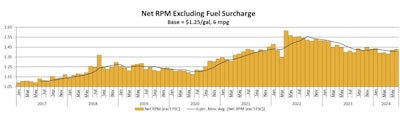

Backing an average fuel surcharge ($1.25/gal. cost basis) out of average revenue per mile for all ATBS client owner-operators shows the underlying freight rate for them historically, here shown dating all the way back to 2017.

Backing an average fuel surcharge ($1.25/gal. cost basis) out of average revenue per mile for all ATBS client owner-operators shows the underlying freight rate for them historically, here shown dating all the way back to 2017.

Hosted noted a "new floor" for rates in the marketplace with the above chart, between $1.35 and $1.45 per mile. up considerably from pre-pandemic times given how much owner-op costs have risen.

"Truck payments, insurance, fuel, maintenance -- it’s all gone up considerably," he said. "We’re not going to get much lower than this -- we’re bouncing along the bottom, waiting for something to kickstart us."

[Related: Diesel hits lowest national average since Fall 2021]

ATBS is Overdrive's primary content partner in the annually updated "Partners in Business" book for new and established owner-operators, a comprehensive guide to running a small trucking business sponsored for 2024 by the Rush Truck Centers dealer network. Follow this link to download the most recent edition of Partners in Business free of charge.