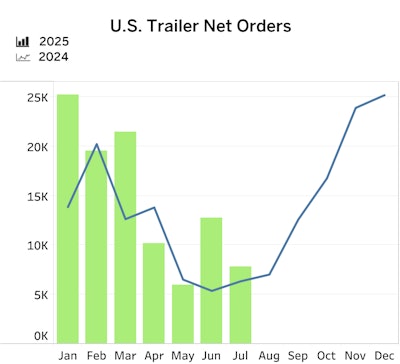

FTR Transportation Intelligence reported that U.S. trailer net orders slid in July, down 39% month-over-month to 7,794 units, significantly under June’s unanticipated rebound.

U.S. trailer net orders was down 39% month-over-month in JulyFTR

U.S. trailer net orders was down 39% month-over-month in JulyFTR

Tariff pressures and freight uncertainty erased June’s dry van-led rebound, FTR said. Despite the pullback, orders were still 23% higher from a year ago. Year-to-date, orders stand at 102,991 units, up 31% year-over-year and averaging 14,713 per month.

Cumulative net orders for the 2025 season (September 2024-July 2025) total 181,430 units, down 5% year-over-year and averaging 16,494 per month.

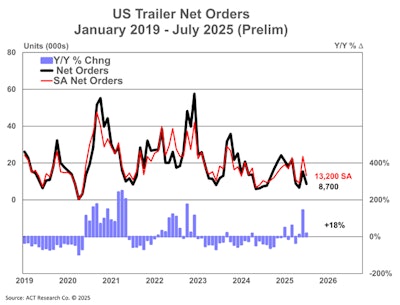

Trailer net orders was down 43% month-over-month in JulyACT Research

Trailer net orders was down 43% month-over-month in JulyACT Research

ACT Research’s estimate ran slightly above at 8,700 units, down 43% month-over-month and up 18% year-over-year.

Both indicated improvements in cancellations. FTR reported that order cancellations were 17% of gross orders in July, down significantly from May’s 39% peak. ACT showed cancellations easing to around 1.8% of backlog in July, down from 4.2% of backlog in June.

Tariff pressures and ongoing headwinds

Dan Moyer, senior analyst, commercial vehicles at FTR, warned that the trailer market faces mounting tariff pressures.

Higher tariff rates on major trading partners took effect on August 7, with expanded 50% tariffs on steel and aluminum, including imported components and fully assembled imported trailers effective August 18.

Elevated tariffs could affect the trailer market in both supply and demand, Moyer said. “OEMs and suppliers must either absorb margin losses or raise prices, possibly accelerating industry consolidation and favoring larger, vertically integrated players,” he said.

Fleets, meanwhile, are extending replacement cycles, leaning on used equipment, and deferring expansion, he said.

Moyer added that the industry is shifting toward “heightened price sensitivity and cautious capital spending” as supply chains weigh domestic sourcing at structurally higher cost levels, with policy uncertainty further adding volatility and making long-term planning difficult.

Meanwhile, Jennifer McNealy, director of commercial vehicle market research and publications at ACT Research, emphasized the seasonality of July's weakness. “Sequentially, lower July net order intake was expected, as it is one of the weaker order months of the annual cycle, especially given that June’s data surprised to the upside.”

McNealy noted that orders remain sufficient to support 2025 build rates, but pointed out concerns on “moderating economic activity, ongoing weak for-hire carrier profitability, and ambiguous policy shift” as challenges to stronger demand.

Build and backlog

FTR also noted that trailer build slipped 1% month-over-month and 4% year-over-year to 17,999 units in July. YTD 2025 build is down 23% year-over-year at 116,826 units, averaging 16,689 per month. With net orders trailing behind, backlogs fell by 11,364 units (-11% month-over-month; -10% year-over-year) to 92,132 units. The backlog-to-build ratio dropped to 5.1 months, which FTR said signals potential production headwinds if order activity does not rebound when 2026 order boards open next month.