Truckload carriers navigate continued excess capacity and depressed rates, while less-than-truckload carriers utilize strong pricing discipline to sustain profitability, according to a recent report.

The TD Cowen/AFS Freight Index analyzed freight data from 1,800 clients of various sizes and industries, along with past performance and advanced analytics to offer a forecast for the quarter.

Though the initial shock of tariff announcements has diminished from earlier this year, businesses are continuing to navigate the effects of shifting policies, said Andy Dyer, CEO of AFS. “We’re also in year three of an unusually long downward freight cycle, and carriers are relying on hard-won lessons of the past to prioritize profitability and hang on in a soft environment.”

Truckload sees mixed signals

For the third quarter, after several year-over-year declines, the average linehaul cost per shipment edged up 0.2% from last quarter and 1.5% year over year. “Underlying conditions suggest the recovery remains tentative,” it said.

Some macroeconomic indicators pointed to a “more encouraging picture,” including higher-than-expected GDP growth in Q2 and a quarter-point rate cut in September by the Federal Reserve, with the possibility of two additional reductions before year-end.

Despite a small year-over-year increase in linehaul cost per shipment, Aaron LaGanke, vice president of freight services at AFS Logistics, pointed out that oversupply continues to prevent a stronger truckload rate recovery.

“We will need to see a supply side correction for any change to happen in the marketplace,” LaGanke said.

Capacity attrition has also been slow, he added. “Some say that many carriers did well during the post-COVID boom, which has helped soften the years to follow.”

Meanwhile, freight demand remains soft, he said, and shippers have effectively leveraged the contract market to limit increases for volume.

The report also pointed to several factors affecting the truckload market, such as uncertainty on tariff policies that has constrained the freight market. In addition, heightened enforcement by the Department of Transportation on labor and language compliance rules prompted the exit of roughly 3,000 commercial drivers, further straining capacity conditions.

“Enforcement and rule changes for non-domiciled CDL holders could tighten capacity, especially in the South, Southwest, and major port regions where these drivers are most active,” said LaGanke, adding that reduced driver availability in these regions could lead to localized rate pressure, though the timing remains uncertain.

“The impact is likely to be most visible during seasonal surges such as the fourth-quarter retail push and second-quarter produce season,” LaGanke added.

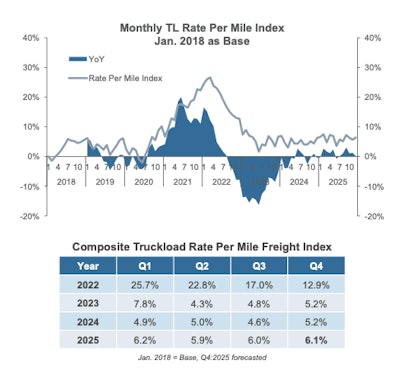

Looking ahead to Q4, the TD Cowen/AFS Truckload freight Index is projected to reach 6.1%, representing a slight 0.1% quarter-over-quarter increase and a 0.9% year-over-year gain.

The TL Rate Per Mile Index is forecasted to extend its moderate year-over-year growth and reach 6.1% in Q4 2025.

LTL carriers showcase pricing discipline

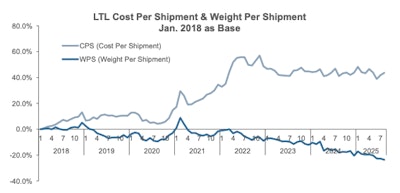

LTL cost per shipment fell 1.8% from the last quarter, with the average weight per shipment down 3.0%. The report noted that the decline in LTL weight per shipment continued to outpace the decline in cost per shipment, widening the divergence between the two metrics.

It added that weaker industrial output and reduced heavy-freight activity drove a 7.4% year-over-year decrease in weight per shipment. However, carriers’ pricing discipline helped limit the year-over-year cost per shipment decline to just 0.7%.

In addition, a 5.6% increase in average carrier fuel surcharges and a 1.3% increase in average length of haul exerted upward pressure on cost per shipment.

Following a record high of 65.1% in Q3, the TD Cowen/AFS LTL Freight Index expects to ease slightly to 64.8%, which would represent a 1.1% year-over-year gain.

Similar to the truckload market, it noted that ongoing tariff policy changes continue to inject uncertainty into pricing and network planning.

Manufacturing indicators also remained weak. The ISM Manufacturing PMI Index remained in contraction territory for the seventh straight month in September 2025, with a reading of 49.1%, a slight improvement from August.

Even as freight demand and industrial activity remain subdued, the report noted that LTL cost per shipment has shown limited volatility and stayed elevated since Q2 2023, indicating carriers’ success in yield management and margin protection strategies.

LTL rates stayed resilient because carriers are focusing on price discipline and customer mix over volume, said Mich Fabriga, vice president of LTL pricing at AFS Logistics.

“It’s common to see carriers taking on increases on certain lanes while reducing rates on others. This allows them to balance their linehaul network and improve density in their pickup/delivery service area to improve operational efficiency, thus reducing overall costs,” Fabriga said.

The exit of Yellow also removed a significant amount of LTL industry capacity, further supporting rate stability, Fabriga noted. Combined with capacity rationalization, network efficiency and improved yield management, these factors have helped sustain LTL rate strength despite subdued demand.