Uncertainty has dominated the past few months, FTR Transportation Intelligence said Thursday in its State of Freight webinar.

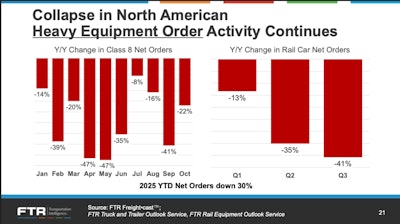

This uncertainty has gradually created a drag on capital investment. The heavy equipment sector exemplifies this paralysis, which FTR Chairman Eric Starks pointed to as concerning. Orders for both trucks and rail cars have stalled, remaining flat and showing no indication of a near-term recovery.

According to FTR, Class 8 net orders in October indicated a -22% year-over-year change, while rail car net orders showed a -43% year-over-year change in Q3. Both markets are down 30% year over year.

Schneider National (CCJ Top 250, No. 6) is one fleet that acknowledged it had paused tractor orders originally planned for November and December builds. In its earnings call with analysts, Executive Vice President and Chief Financial Officer Darrell Campbell said it had originally been included in its capital plans.

Core capital goods orders, which examine orders for durable goods used by businesses, excluding defense and aircraft, have also been flat and haven't seen real growth since 2021, Starks said.

Economic Outlook

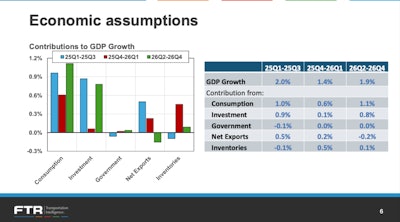

The economy has strengthened and is doing better than expected since May, said economist Bill Witte.

However, Witte said he anticipates a slowdown in Q4 through Q1 2026 before an expected recovery in Q2 2026.

“We think that the rest of this year and the beginning of 2026 are going to be a little bit tougher, but with growth slowing down — at least overall GDP — but not disastrously so,” he said.

He noted that forecasts are skewed by “underlying instability and uncertainty that’s been surging through the economy.”

“We’re kind of right at that cusp there, where we don’t see a huge amount of freight growth… and that’s something we’re going to have to keep an eye on longer term,” Starks said.

Witte added that the slowdown is coming from consumption and particularly a bigger slowdown in investment. Part of the slowdown reflects pull-forward demand, Witte said, as consumers rushed purchases ahead of anticipated tariffs.

Labor market strain

Both economists point to the labor market as an emerging vulnerability. Unemployment is expected to rise slightly into the 4% range in the coming quarter, Witte said, and Starks noted it as a “problematic area” worth watching, especially in the first half of 2026.

Economic data releases, including the Bureau of Labor Statistics’ jobs reports, Consumer Price Index, and Producer Price Index, haven’t been published amid the government shutdown.

Looking at another dataset, ADP Research reported that U.S. private sector employment increased by 42,000 jobs in October. However, weekly data noted an average weekly loss of 11,250 jobs through late October, suggesting that the “labor market struggled to produce jobs consistently during the second half of the month,” ADP said.

This aligns with Goldman Sachs, which estimated about 50,000 jobs were lost in October, marking the largest monthly decline since 2020.

“We expect deterioration,” said Witte, adding that underlying labor demographics are negative, with little sign of improving.

As labor market pressures continue, Witte said that lower consumer confidence appears inevitable.

Policy paralysis

Witte noted that there’s an underlying uncertainty with policy: “Policy is a mess. Monetary policy is goofed up, fiscal policy is goofed up, (and) trade policy is really goofed up. International relations are arguably better than you’d expect, but there’s still enormous amounts of uncertainty and risk there.”

Starks pointed out that tariffs continue to be a “rollercoaster” and add additional unknowns for another year.

“Businesses will continue to sit on the sidelines,” he said. “What the administration is needing to do is to create some certainty.”

Looking at the probability of a recession, Starks said FTR estimates a 35% chance of a recession within the next four quarters, down from its projection of 40% over the summer.

On the upside, FTR projects a 10% probability of growth, though Starks said “the picture is very, very murky.”