Foreign driver enforcement continues to be one of the hottest topics in the industry, according to FTR analysts at this week’s State of Freight webinar.

Driver enforcement and capacity

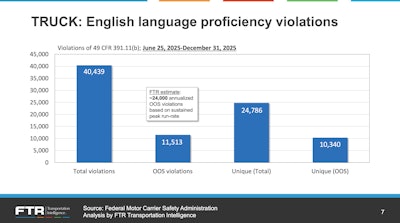

Avery Vise, FTR’s vice president of trucking, noted that pressure on foreign drivers has resulted in significant numbers. Based on data from June 15 to December 31, 2025, over 11,000 drivers were taken out of service through violations. Notably, 90% of those cited have not received a subsequent violation, suggesting a positive shift in behavior.

When annualized based on the peak enforcement period, FTR estimates this represents approximately 24,000 drivers. However, Vise clarified that while the figure sounds substantial, the market impact is limited and not a “market-changing number,” though it does contribute to the overall decline in capacity.

Texas, Arkansas, and Wyoming represent 23% of violations. Vise explained that an exception exists for Mexican border commercial zones: “FMCSA is excluding drivers who are cited within the Mexican border commercial zones, and that’s where the vast majority of those violations occur. If you were to extend that to the border zones, it would be enormously disruptive, which is why FMCSA didn’t do it.”

Manufacturing and equipment trends

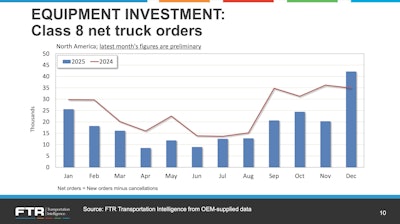

On a positive note, analysts noted the boost of Class 8 truck orders in December, reversing a year-over-year downward trend seen in previous months.

Vise explained this was driven by two issues: clarity on tariffs and emissions regulations. “This clarity gave a green light to some of these leads,” he said. However, FTR CEO Jonathan Starks cautioned that this does not signal an inflection point, as demand fundamentals remain “pretty weak.”

The analysts shared a cautiously optimistic view for the housing and durable goods markets, anticipating improvement through 2026 if interest rates continue to decline. Conversely, industrial and equipment investment has been particularly weak. Starks noted, “It was very much a tariff-informed environment. Either you’re pulling goods forward ahead of tariffs or you’re utilizing inventory ahead of tariff changes.”

Manufacturing followed a similar pattern, with a rush of activity early in 2025 as businesses moved to beat tariff-related price hikes, followed by a steady deceleration. Starks also noted a disconnect between manufacturing growth and freight demand; while the computer, electronics, and pharmaceutical sectors have seen a strong upward trajectory, these high-value goods do not create sustained, high-volume freight demand.

Economic headwinds

Starks projects that inflation will remain elevated but will not accelerate dramatically. However, he noted that stability will depend on:

- Employment levels.

- Continued tariff uncertainty.

- Consumer weakness.

- USMCA trade negotiations set to begin in July.

Freight market outlook

Vise highlighted a slight inflection in the freight market over the last six weeks, starting around Thanksgiving, attributed to better capacity conditions. However, he cautioned that FTR expects a significant decline in spot rates for both dry van and refrigerated segments over the next few weeks, barring a substantial weather event. The flatbed market followed a similar pattern for most of 2025, with early-year strength driven by "tariff avoidance."

FTR Forecast Highlights:

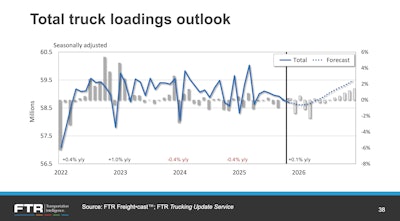

- Total truck loadings: Forecasted to remain flat for the year.

- Recovery timeline: Freight recovery is expected to begin around mid-year, with year-over-year gains appearing by year-end.

- Utilization: Vise described a moderate tightening with upside potential: “Stronger freight could very easily yield significantly stronger utilization and stronger rates.”

- Spot rates: After a slight 2% growth in 2025, FTR forecasts 3.6% growth for 2026, which Vise characterized as a “floor based on what we’ve been seeing recently.”