Class 8 truck orders saw a surge in December, with preliminary figures from FTR Transportation Intelligence showing net orders jumped to 42,200 units—the strongest performance since October 2022. This represented a 108% increase from November and a 21% gain compared to December 2024, significantly higher than the 10-year December average of 29,351 units.

The year-over-year growth came primarily from on-highway orders, though vocational markets saw similar month-over-month gains, FTR reported.

Although December saw an upturn, cumulative orders for the 2026 season (September through December 2025) were 22% below the prior year. Total orders over the past 12 months reached just 252,178 units, reflecting ongoing market challenges.

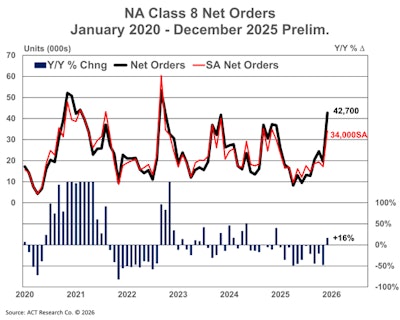

ACT Research reported similar findings, with December preliminary orders of 42,700 units marking a 16% year-over-year increase. Carter Vieth, research analyst at ACT Research, noted that after a sluggish 2025 amid flat freight rates and regulatory uncertainty, demand “jolted awake” in December.

“A firmer economic foundation, increasingly aged fleets, and the certainty of higher costs and new technologies in 2027 were the impetus, in our opinion, for the sudden change of heart. As trucking fundamentals remain thin, if improving, we view December’s Class 8 result as overstating the improvement,” Vieth said.

FTR noted that the December uptick seems linked to improved policy visibility regarding tariff and emissions policies in October and November.

The Section 232 tariffs on Class 3-8 trucks that took effect in November proved less burdensome than many had anticipated. Additionally, the Environmental Protection Agency is expected to propose modifications to the 2027 NOx rule in March or April. These modifications are expected to retain the 2027 implementation date and the 0.035 g/hp-hr standard while removing costly extended warranty requirements and adjusting other compliance provisions.

“Word of the EPA’s plan did not circulate until about 10 days before Thanksgiving, which probably is a factor in why the order surge occurred during December and not November,” FTR noted.

[Related: Truck aftertreatment systems are here to stay]

Dan Moyer, FTR’s senior analyst of commercial vehicles, cautioned that despite greater policy clarity, "freight demand remains soft, fleet profitability is constrained, and capital discipline persists amid rising costs.”

Moyer suggested the order spike likely stems from previously deferred orders and early positioning for a modest EPA 2027 NOx pre-buy, rather than a broader market demand improvement. Sustained recovery will require better economic and freight market conditions, he said.