Projections released by American Trucking Associations (ATA) Wednesday show truck tonnage will grow to 14.2 billion tons by the year 2034.

ATA Chief Economist Bob Costello noted that the agency's latest forecast keeps trucking, which moved 72.2% of all freight tonnage and accounted for 79.2% of revenue in 2022, atop the U.S. freight-mover pyramid.

"That market share will continue to hold over the next decade, as the country will still rely on trucking to move the vast majority of freight," Costello said.

Costello expects that overall truck tonnage will grow from an estimated 11.3 billion tons this year to 14.2 billion tons in 2034, representing 72.4% of the freight tonnage in 2023 and 72.6% of tonnage at the end of the forecast period. Trucking’s revenues will grow from $1.01 trillion in 2023 to $1.51 trillion in 2034, which will account for 78.8% of the freight market.

Facing an ongoing shift of some on-highway freight to intermodal rail, ATA forecasts rail intermodal revenues will grow from $21.7 billion in 2023 to $35.2 billion in 2034. As coal and bulk petroleum shipments wane over time, rail carload tonnage will fall from 11% of total freight to 10.1% by 2034, ATA said.

Air cargo tonnage will grow from 17.6 million tons this year to 23.7 million tons in 2034. Pipelines will see their share of freight tonnage grow from 9.8% in 2023 to 10.4% in 2034.

“Knowing where our industry and economy are headed is critical for decision makers,” said ATA President and CEO Chris Spear. “This Freight Forecast should be top of mind for policymakers in Washington, Sacramento and wherever decisions are being made that affect trucking.”

Long road to recovery

ATA's forecast comes as trucking works to dig itself out of historically significant poor times.

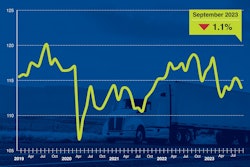

Truck operating costs are significantly above spot rates. The margin between cost and contract rates, which continue to decline and are about 16% lower year-over-year, is positive but tight.

Real spending on goods is rising after two years of stagnation, according to Uber Freight's 2023 Q4 market update & outlook. In Q3, spending was 0.5% higher quarter-over-quarter and 2.3% higher year-over-year. Strength was driven by durable goods (+1.1% quarter-over-quarter), particularly automotive. Consumers are saving less to spend more: the personal saving rate dropped to 3.4% in September, half its pre-pandemic level.

Truckload demand, having steadily increased over 2023, turned positive year-over-year for the first time in 9 months. Truckload demand likely hit the bottom in April 2023, according to Uber Freight's report, and increased in the following months. In Q3, it rose by 1.2% quarter-over-quarter, and was flat year-over-year. Meanwhile, supply fell by 0.5% in Q3, but was still 1.4% higher than a year earlier. The manufacturing economy contracted for the 12th consecutive month, according to ISM Purchasing Managers Index.

Trucking employment fell by 24,000 (-1.5%) in Q3, reflecting the Yellow bankruptcy. In October, it fell further by 5,000, according to Uber Freight, and was 1.7% lower year-over-year. Long distance truckload employment, which is a better predictor of spot rates, has also been falling but is still only 1.1% below its all-time high.

LTL tonnage continued to decline in Q3, according to Uber Freight, but individual carriers’ tonnage are showed signs of improvement in September due to Yellow’s closure. Overall LTL tonnage and shipment count is expected to remain at reduced overall levels through the end of the year and into next year, and average shipment size also continues to decline.