With rate increases hard to come by, some carriers may have hoped to raise income through renegotiating accessorials – but customers are still unwilling to chip in for the little extras, according to a recent trucking industry survey. On the brighter side, detention-time deals are on the upswing.

Courtesy Transport Capital Partners

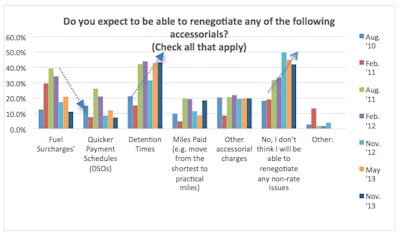

Courtesy Transport Capital PartnersForty-two percent of carriers indicated they do not expect to be able to renegotiate accessorials, including practical miles and quicker payment schedules, reports Transport Capital Partners in the firm’s fourth-quarter take on business expectations. That percentage is down slightly from the past two quarters.

Other specifics:

— Over the last two years the number of carriers able to raise fuel surcharges has dropped from 30 percent to 11 percent. Pessimism about assessorials is greater among smaller carriers than the larger carriers (50 percent vs. 38 percent).

— Carriers are more positive when it comes to detention times, as 43 percent now expect to renegotiate. While renegotiating detention times does not necessarily raise cash, it can make equipment more productive, TCP notes.

— Approximately 30 percent of larger carriers think they will be able to renegotiate miles paid (i.e., move from shortest route to practical route). This change – were it to materialize – would have a significant impact on revenues, even with stagnant rates.

Despite the lack of rate increases and static assessorials, slightly more than half of carriers (54 percent) indicated they are getting an adequate rate of return – the highest level yet for this survey, TCP adds.

Related: Low GDP growth, higher costs will pressure carrier margins

But the numbers are not entirely encouraging, according to the analysis: 43 percent of carriers still believe they are not getting an adequate return. (The issue may lie in how carriers define “an adequate rate of return,” TCP points out: “Adequate” for one carrier may be “inadequate” for another.)

“For the industry to thrive, and not just survive, a large percentage of carriers must be making adequate rates of return to afford the investment in equipment and support services required by modern supply chains,” says Richard Mikes, TCP partner.

Carriers are also not seeing improvement in credit availability, according to the survey. Approximately 75 percent expect credit availability to remain the same – a similar number to one year ago.

“Credit availability and carrier profitability go hand–in-hand, both are essential to replace aging fleet assets and to grow capacity,” says Steven Dutro, TCP Partner. “Carriers with stronger profitability and cash flows will find credit available and affordable and will be better positioned to gain market share.”

Complete details and graphs from TCP are available here.