Tonnage down 0.6% in May

ATA index up 7.2% year-over-year

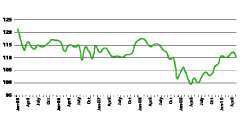

The American Trucking Associations’ advance seasonally adjusted For-Hire Truck Tonnage Index decreased 0.6 percent in May, the first month-to-month drop since February. The reduction, which followed an upwardly revised 1 percent increase in April, put the SA index at 109.6. The nonseasonally adjusted index, which represents the change in tonnage actually hauled by fleets before any seasonal adjustment, equaled 108.3 in May, down 2.8 percent from the previous month.

ATA TRUCK TONNAGE INDEX, SEASONALLY ADJUSTED, 2000 = 100 ---ATA Chief Economist Bob Costello says truck freight tonnage is going to have ups and downs, but the overall trend continues in the right direction.

ATA TRUCK TONNAGE INDEX, SEASONALLY ADJUSTED, 2000 = 100 ---ATA Chief Economist Bob Costello says truck freight tonnage is going to have ups and downs, but the overall trend continues in the right direction.Compared with May 2009, SA tonnage increased 7.2 percent, the sixth consecutive year-over-year gain; in April, the year-over-year increase was 9.5 percent. Year-to-date, tonnage is up 6.2 percent compared with the same period in 2009.

ATA Chief Economist Bob Costello says truck freight tonnage is going to have ups and downs, but the overall trend continues in the right direction. “Despite the month-to-month drop in May, the trend line is still solid,” Costello says. “There is no way that freight can increase every month, and we should expect periodic decreases. This doesn’t take away from the fact that freight volumes are quite good, especially considering the reduction in truck supply over the last couple of years.”

ATA calculates the tonnage index based on surveys from its membership. The report includes month-to-month and year-over-year results, relevant economic comparisons and key financial indicators. The baseline year is 2000.

IN BRIEF

* Class 8 truck net orders in North America jumped 20.5 percent in June over May and soared 90.8 percent above June 2009, according to preliminary data from FTR Associates. June orders reflect an annualized rate of 188,000 units, boosting the annualized rate for the first half of this year to 137,000 units.

* Spot market freight availability increased 216 percent in May compared to May 2009 and was the strongest volume for May in 10 years, according to TransCore’s North American Freight Index. Spot freight, which has been higher than normal since January, increased in May for dry vans and refrigerated vans in advance of the peak summer season, but spot freight for flatbeds fell by 15 percent compared to April’s high level.

* J.J. Keller & Associates’ www.2290online.com website now is accepting 2010 IRS Heavy Vehicle Use Tax (HVUT) forms. Users have anytime access from anywhere, centralized tax filing and e-mail reminders of annual filings, while companies with multiple locations can maintain a repository of tax data and filing history; multiple account management also is available for third-party filers.

* The Tire Industry Association entered into an agreement with Comdata Corp. to endorse the Comdata Maintenance Discount Network. Through Comdata’s network, TIA members have access to cardholders who use Comdata to pay for services such as tire repairs.

* GE Capital Fleet Services named Jon Parker senior vice president of sales, responsible for strategic sales efforts and working with product development teams to ensure customer needs and insights are reflected in new products and services.

Year-over-Year NAFTA trade up 32.4% in April

Trade using surface transportation between the United States and its North American Free Trade Agreement partners Canada and Mexico was 32.4 percent higher in April 2010 than in April 2009, reaching $65.8 billion, according to the Bureau of Transportation Statistics of the U.S. Department of Transportation. The increase was the third consecutive monthly increase of at least 24 percent from the previous year, but freight value in April 2010 still remained 11.4 percent less than the value in April 2008.

BTS, a part of the Research and Innovative Technology Administration, reported that the value of U.S. surface transportation trade with Canada and Mexico fell 5.9 percent in April 2010 from March 2010; month-to-month changes can be affected by seasonal variations and other factors. The value of U.S. surface transportation trade with Canada and Mexico in April was up 12.9 percent compared to April 2005 and up 40.5 percent compared to April 2000. Imports in April were up 38.2 percent compared to April 2000, while exports were up 43.3 percent.

U.S.-Canada surface transportation trade totaled $39.9 billion in April, up 32.1 percent compared to April 2009. U.S.-Mexico surface transportation trade totaled $25.9 billion in April, up 32.8 percent compared to April 2009.

The TransBorder Freight Data are a unique subset of official U.S. foreign trade statistics released by the U.S. Census Bureau. New data are tabulated monthly, and historical data are not adjusted for inflation. Surface transportation consists largely of freight movements by truck, rail and pipeline; in April, 86.6 percent of U.S. trade by value with Canada and Mexico moved on land.

Interest in acquiring carriers spikes, TCP survey finds

Transport Capital Partners’ Business Expectation Survey for the second quarter of 2010 found that almost half of carriers surveyed are translating optimism for the year ahead into interest in buying another company. “The present surge of freight and general outlook for improved rates has spiked interest in acquisitions, rising from around mid-30 percent range by respondents in the prior five quarters to 45 percent now interested,” says Richard Mikes, TCP partner.

“Carriers across all sizes are interested in buying, but larger carriers are more interested in finding opportunities,” says Lana Batts, TCP managing partner. Stock values for publicly traded carriers have risen over the past year, reflecting general optimism for transportation firms, though prices have dropped somewhat with the general market recently.

TCP uses the quarterly survey to collect the insights and opinions of executives nationwide in order to report on the current state of the industry and future expectations. TCP’s surveys over the last year show that carriers have become less interested in selling this quarter. When asked in February 2009 if they had given consideration to leaving the industry if tonnage does not increase in the next six months, more than 20 percent of all carriers said yes. Currently about 20 percent of small carriers are still replying yes to the question, while only 8 percent of the larger carriers are saying yes. n