Spot market rates and intermodal volumes continue to set records, while import container volume has climbed to a post-recession high as retailers scramble to work around the West Coast ports’ labor issues. Truck fleets are increasingly burdened, however, by contract rates that aren’t keeping pace with increased costs for driver recruitment and retention.

Here’s a roundup of the latest freight reports.

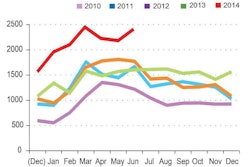

• Spot market activity declined 21 percent last week, due to the short work week that included the 4th of July, according to the DAT Trendlines report for week of June 29-July 5. Still, rates soared 7 cents per mile for both vans and reefers, while flatbed rates rose 10 cents, as shippers rushed to close the fiscal quarter on a high note. (Slide 1)

Van rates in June were 12 percent higher on the spot market than the year before, with flatbed rates up 11 percent and reefer up 8 percent. (Slide 2)

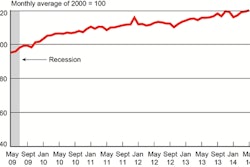

• Intermodal traffic in June was up 6.7 percent over June 2013, and the weekly average was the highest for any month in history, the Association of American Railroads says. The peak for intermodal traffic is generally in the fall, so look for more records to be set in the months ahead, the association notes.

Through the first six months of 2014, containers accounted for 88.4 percent of intermodal volume, a higher percentage than ever before. (Slides 3 and 4)

• Import volume at major U.S. container ports is expected to total 1.5 million containers this month. That’s the highest monthly volume in at least five years and follows a trend of unusually high import levels that began this spring as retailers worked to import merchandise ahead of any potential problems.

With West Coast longshoremen still negotiating a new contract, retailers are bringing holiday merchandise into the country at record levels to protect against potential supply chain disruptions, according to the monthly Global Port Tracker report by the National Retail Federation and Hackett Associates.

“We’re still hoping to get through this without any significant disruptions but retailers aren’t taking any chances,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “Retailers have been bringing merchandise in early for months now and will do what it takes to make sure shelves are stocked for their customers regardless of what happens during the negotiations.”

• FTR’s Trucking Conditions Index (TCI) for May, at a reading of 5.74, reflects some headwinds affecting truck fleet results. Modest recovery growth along with the lack of acceleration in contract rate increases are accompanied now by increased labor and recruiting overhead costs, the report says. (Slide 5)

A near capacity crisis environment through May is expected to have eased somewhat in June. While still in solidly positive territory, the TCI outlook from FTR has moderated.

“Capacity is tight but has moderated from the critical level that we operated in during and just after the winter months,” says Jonathan Starks, FTR’s director of transportation analysis. “Freight rates seem to be a tale of two cities with contract rates very stable and only showing modest growth, yet spot rate activity has been quite strong since winter hit and has not let off since then.