CCJ‘s Indicators rounds up the latest reports on trucking business indicators on rates, freight, equipment, the economy and more.

Spot market rates buck seasonal trends as reefer, van rates slump

(*Rates data from Truckstop.com)

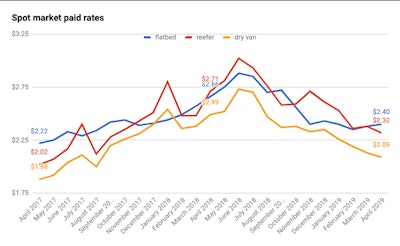

(*Rates data from Truckstop.com)Per-mile flatbed rates on the spot market climbed two cents in April, according to Truckstop.com, while van and reefer rates sank a few cents each. April’s rates report, based on transactional data from Truckstop.com’s loadboard and freight-matching platform, signals that rates continue to float downward as the market repositions from 2018’s boom.

Rates generally see an upswing in April, kicking off a usual multi-month climb during the typical spring-to-summer spike in freight demand. That usual rates spike did not materialize this April, however, as rates prod to find new footing in the current economic cycle.

Flatbed rates in April climbed to a $2.40-a-mile national average — up two cents from March but down 26 cents a mile from the same month last year. Flatbed rates peaked at $2.88 a mile last June, then stumbled throughout the second half of 2018 and into the first two months of 2019. Flatbed’s average was 18 cents a mile higher than April 2017’s average of $2.22.

Reefer rates slipped 6 cents a mile in April from March, to $2.32, and were down 39 cents a mile from last April. Reefer rates peaked at $3.02 last June. Reefer’s average was still up 30 cents from April two years ago.

Dry van’s $2.09 average in April was down 4 cents from March and down 40 cents from April 2018. However, the average was up 21 cents a mile from April 2017.

Trucking employment growth stalls: The for-hire trucking industry dropped 500 jobs in April, according to the Department of Labor’s monthly Employment Situation Report. It’s the first month-to-mont drop since April 2018 and only the second in the last 20 months. The DOL had reported a preliminary 1,200-job decline for March, but the agency revised that figure to show a 300-job increase.

However, employment growth in for-hire trucking has stalled. From May 2018 through January 2019, the industry averaged growth of nearly 4,000 jobs a month. In the prior three months, the industry has added just 300 jobs total, with April’s 500-job decline negating February’s 500-job increase.

However, employment in the industry is still at record levels. Employment in the for-hire trucking segment totaled 1.5163 million in April — a gain of 34,900 jobs from the same month last year. The U.S. economy as a whole in April added 263,000 jobs, and the unemployment rate fell to 3.6 percent.

The transportation and warehousing sector as a whole added 11,100 jobs in April. Of major freight producing sectors, the construction industry added 33,000 jobs, and the manufacturing sector added 4,000 jobs.