As Werner Enterprises (CCJ Top 250, No. 14) announced its $245 million acquisition of Murfreesboro, Tennessee-based FirstFleet (No. 48), executives say the deal is a strategic move to focus on the dedicated trucking business.

“We’ve been very deliberate over the past few years about transitioning our portfolio increasingly towards the higher-margin dedicated trucking business, a $30 billion-plus total addressable market that is more resilient, contract-based, and protected by high barriers to entry,” said Derek Leathers, chairman and CEO of Werner, in a conference call with analysts discussing the acquisition.

The deal represents a move for the fleet to pivot away from the boom-and-bust cycle among truckload carriers, noted FTR Vice President of Trucking Avery Vise. Since 2014, market volatility has made capacity planning difficult, creating cost inefficiencies.

“Some carriers have concluded that a better long-term strategy is to provide greater service for a smaller cadre of steady customers, thus achieving a solid return on investment that is consistent,” Vise said.

Leathers explained that Werner’s approach creates a balanced portfolio while reducing risk as the company leans into its dedicated business and one-way segment.

As markets recover, Leathers noted that having more assets matters, especially in the coming months and quarters. As a result, Werner operates with 52% of revenues in dedicated, while maintaining its one-way fleet to provide market flexibility. As Leathers noted, the one-way fleet “serves as a surge capability within dedicated, which now has even more demand for that surge with the acquisition itself.”

Leathers highlighted FirstFleet’s value proposition: “They've done some incredible things for many, many decades and had to do so with arguably one hand tied behind their back. They didn't have the same surge capabilities. They didn't have the same abilities to bring multiple products to bear, and yet still build a hell of a business."

Differentiators like scale, flexibility, industry expertise, and cross-selling opportunities were critical factors, Leathers said. Additionally, the deal added scale, geographic density, and market diversification; FirstFleet’s deep industry expertise in grocery, bakery, and corrugated packaging; customer dedication; safety and innovation; and a proven track record of profitable growth.

The deal brings FirstFleet’s 2,400 tractors and 11,000 trailers to Werner’s total dedicated fleet, totaling approximately 7,365 trucks.

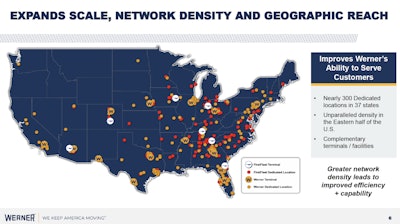

The acquisition creates nearly 300 dedicated locations across 37 states. Leathers explained the compounding benefits: “In dedicated, although the assets are, in fact, dedicated to particular customers, the more density and the more other fleets you have in the neighborhood—in the vicinity regionally or otherwise—just gives you the opportunity to bring surge capabilities in all kinds of additional capacity and really, basically, simultaneously give the customer a better product while giving ourselves a lower cost to serve.”

Werner execs noted that the carrier can now deploy assets more efficiently, reduce deadhead miles through network utilization, provide faster response times for surge needs, and share maintenance facilities to reduce third-party costs.

Addressing concerns about integration execution, Leathers pointed to four acquisition deals Werner has made. “We’ve had pretty good success with revenue retention on those… I think in three of the four, revenues were up year over year at the one-year anniversary mark.”

Chris Neil, senior vice president of pricing and strategic planning at Werner, emphasized patience. “We're going to do this right and take our time to realize value but do it in a thoughtful way... Once we get, call it, 18 months to two years under our belt, or even sooner, we may see other opportunities.”

M&A wave likely to accelerate

As Werner enters the top tier of dedicated carriers, Peter Stefanovich, president of Left Lane Associates, noted that the move could motivate carriers to acquire quality dedicated carriers before their competition does.

“The only way for exponential growth is by buying your competitors. With the market starting to pick up, we’ll see more transactions as the conditions change,” Stefanovich said.

Vise added that some carriers might find it advantageous to acquire carriers already succeeding in the dedicated business segment—not only bringing in business, but also expertise.

So, are smaller dedicated carriers up for M&A opportunities?

Stefanovich said carriers with around $100 million in sales will be a good fit for top players in the dedicated sector.

“As many players continue to get further ingrained in their customers' supply chain, they will often find gaps they need to fill. Often those gaps are best filled with regional, smaller dedicated carriers with existing geographic and customer footprints,” Stefanovich said.

Meanwhile, Vise said smaller players in the dedicated space are at a greater risk of financial challenges than large players if they lose a customer.

Having the right partners is essential, he said, such as shippers whose volume will neither disappear nor grow too fast for the business to keep up.