The Class 8 truck orders surge in December continued till January, with analysts noting some improvement and lingering uncertainty on market conditions.

Preliminary figures from FTR Transportation Intelligence totaled 32,500 units—down 24% from December, but up 27% compared to January 2025. This marked the second straight month of year-over-year growth, the first since April and May 2024, with orders well above the 10-year January average of 26,300 units.

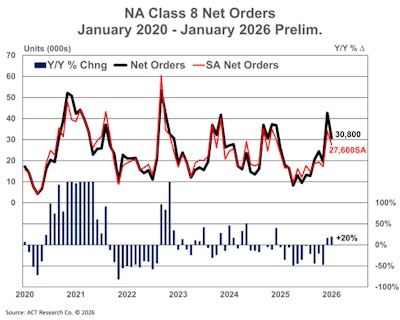

ACT Research indicated similar sentiments, with preliminary Class 8 orders at 30,800 units, also up 20% year over year.

Following weak October and November results, ACT Research analyst Carter Vieth noted several factors appeared to have spurred recent activity: “The US economy continues to outperform expectations, clarity surrounding EPA’27 bolstered demand, and arguably most importantly, since the end of November, we’ve seen a sustained run up in spot rates after three successive Midwest snowstorms.”

However, FTR cautioned that the improvement reflects timing rather than being cyclical. Despite the year-over-year gains in December and January, total orders for the 2026 season (September-January) remain 13% down from last year’s pace.

This suggests fleets are delaying replacement purchases rather than experiencing renewed demand, FTR said.

This is also reflected in a recent Bloomberg and Truckstop survey. Though the surveyed 600 small motor carriers and freight brokers indicated a positive outlook for the first three to six months of 2026, uncertainty is a critical factor in staffing and deferring investment plans. Carriers remain cautious in capital spending, with 68% having no plans to purchase additional equipment in the first half of 2026.

Greater clarity on tariff-adjusted pricing and regulatory requirements—particularly tariffs on Classes 3-8 trucks and EPA 2027 NOx standards—appears to have encouraged fleets to proceed with purchases that had been delayed during fall of 2025, FTR noted. This shift could have been the cause of shifting order activity in late 2025 and early 2026 without generating additional incremental demand.

“Some stabilization and improvement in the freight market since late 2025 also may have provided modest support at the margin, but fleet profitability and capital discipline remain binding constraints,” Dan Moyer, senior analyst, commercial vehicles at FTR, said.

Purchasing behavior continues to be replacement-driven with minimal early EPA 2027 influence, Moyer said.

There are still some risks including weak freight fundamentals, cost pressures, geopolitical uncertainty, and broader macroeconomic risk, he noted.

“A durable recovery would require notable and sustained year-over-year order growth as 2026 progresses and meaningful improvement in freight demand, freight pricing, and overall economic conditions,” Moyer said.

On medium-duty trucks, Vieth said orders rose 11% year over year. Given last January was the weakest January for orders since 2013, the 11% improvement seems to be more of an easy comp than meaningful improvement,” he said.