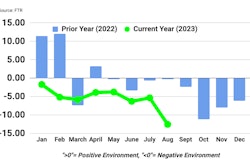

Class 8 orders slid 24% year-over-year, according to ACT Research, reaching 32,287 units thanks to market segments with lingering pent-up demand.

The vocational straight truck market saw orders jump 24% year-over-year. Export market orders were up 91%, and orders destined for Mexico were up 187%. North American Class 8 tractor orders were down 34% year-over-year, with U.S. tractor orders down 47% from year-ago levels.

"The build rate declined nearly 10% month-over-month," said Kenny Vieth, ACT’s president and senior analyst, "leading to 27,999 units of production in October. Anecdotes suggest supply chain issues were at the root of the below-expectations miss. Despite otherwise softening conditions, Q1’24 build expectations remain elevated.

Class 8 build and retail sales continue to track closely, but retail sales ticked down month, causing inventory to move higher, Vieth said.

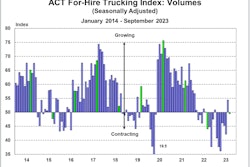

"For carriers, the long bottom in freight rates continues, with spot rates little changed since April. A big driver of rate weakness has been lagged private fleet capacity additions, Vieth said. "As for-hire fleets tend to be the first buyers in line, private fleets have been the drivers of Class 8 market strength in 2023, adding equipment at the bottom of the cycle and prolonging the rate pain.”

Class 8 orders totaled 255,000 units over the past 12 months, according to FTR. The annualized rate over the past six months has been 233,000 units.

"Build slots continue to be filled at a healthy rate," said FTR Chairman of the Board Eric Starks. "We expected a year-over-year decrease in orders and were not surprised by the month-over-month easing, either. The overall picture for truck demand is steady. Despite freight weakness, fleets continue to be willing to order new equipment, affirming our expectations of replacement demand during 2024.”

Trailers orders trend upward

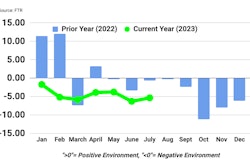

October’s preliminary net trailer orders increased nominally from September to October, at 35,300 units (their highest level since December 2022, according to FTR), but were lower compared to last October, down more than 26% year-over-year, according to ACT Research.

Orders over the last 12 months totaled 294,000 units, according to FTR.

Build improved 4% month-over-month in October but lagged net orders, so backlogs rose for only the second time in 2023. September had been the first month of the year to see an increase in backlogs, according to FTR. While this continues the positive momentum the industry began last month, ACT Research Director CV Market Research & Publications Jennifer McNealy added that two months of robust orders does not guarantee the full year.

"It’s still early in the new year order season to call.” she said. “The data continues to provide mixed messages, with cancellations remaining elevated, driven primarily by the platform and tank segments, even as backlogs remain at healthy levels in general and particularly in the specialty segments.

Starks noted that trailer backlogs relative to production levels overall are in line with normal levels historically, but they vary notably by trailer type, adding the backlog-to-build ratios for van trailers are still elevated and should support current production levels. The ratios are much lower for more specialized trailer types, raising concerns over possible cuts in production down the road. On the plus side, the order increases in October for most specialized trailer types greatly outperformed dry van and refrigerated van trailers, he said.

”The backlog-to-build ratio was well north of five months in aggregate," McNealy added, with some specialty segments having no available build slots until late in 2024 at the earliest.

"We’ve been hearing that order discussions were occurring, and it looks like quotations continue to convert to ‘booked’ business," she said. “Using preliminary October orders and the corresponding OEM build plans from the October State of the Industry: U.S. Trailers report (September data) for guidance, we would expect the trailer backlog to increase by around 7,300 units to about 146,100 units when complete October data are released. As this number is derived from estimated data, note there will be some variability to reported backlogs when final data are collected.”