CCJ graphic by Richard Street

CCJ graphic by Richard StreetThe Payroll Protection Program (PPP) provided hundreds of billions of dollars for cash-starved businesses during the COVID-19 pandemic, and with many customers idled by government-mandated shutdowns, tens of thousands of trucking companies were among those standing in line for a slice of the PPP funds.

The Small Business Administration (SBA) last month said it had approved 4.9 million loans through the end of June totaling more than $521 billion as part of the $2 trillion CARES Act signed into law last spring.

According to data compiled by CCJ from SBA listings, upwards of 100,000 trucking companies received funds ranging from loans of less than $10 (yes, ten dollars) to some in excess of $5 million. Local and long-haul trucking companies snagged as much as $12 billion, more than 2% of all the PPP cash handed out by banks across the United States. Those listings exclude household goods movers.

More than 60% of fleets responding to a CCJ survey last month that measured the coronavirus’ impact on motor carriers said they had applied for PPP funds, with some carriers noting the money was vital for post-pandemic survival. Likewise, in a recent survey of owner-operators and very small fleets (those with nine trucks or fewer) conducted by CCJ sister publication Overdrive, more than half said they had applied for PPP loans.

The number of loans awarded and the size of those loans show the toll that the coronavirus-spurred downturn had on carriers’ cash flow.

Mike Kucharski, co-owner and vice president of JKC Trucking, the largest refrigerated trucking fleet in the Chicago Metro area, said that without the more than $2 million loan that JKC received via the PPP, his company would have endured layoffs en masse, as the majority of its customer base of bars and restaurants were crippled by stay-at-home orders.

“[The loan] was a Band-Aid, but it was a great Band-Aid,” Kucharski said. “Without that money, we would have to cut pay [and] cut drivers a long time ago.”

Nearly 11,000 trucking companies (10,872), as categorized by SBA’s North American Industry Classification System, received PPP loans for amounts greater than $150,000, according to disclosure documents released by the U.S. Treasury Department and SBA last month.

CCJ graphic by Richard Street

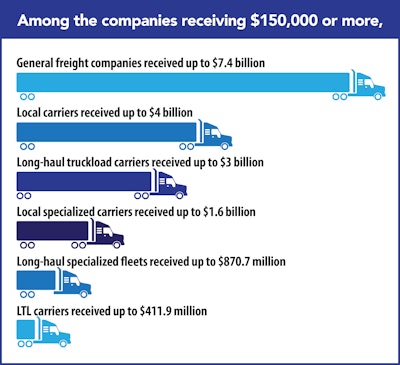

CCJ graphic by Richard StreetAmong the companies receiving $150,000 or more, general freight companies collectively snagged between $3.1 billion and $7.4 billion. Long-haul truckload carriers received between $1.3 billion and $3 billion, leaving between $176.7 million and $411.9 million for less-than-truckload (LTL) carriers and between $1.68 billion and $4 billion for local carriers.

Long-haul specialized fleets altogether received between $371.75 million and $870.7 million, while local specialized carriers received between $658.25 million and $1.6 billion.

With the SBA-backed loan in-hand, JKC Trucking managed to keep all its employees and diversified its business model to add more flexibility.

“Before COVID, we had too much freight,” Kucharski said, noting the company specialized in LTL before adding more truckload business during the pandemic. “We started picking up product where we could to keep the wheels rolling. In the trucking business, there’s a lot of fixed cost. We have to fill that big gap.”

Kucharski used the money for payroll, a condition that should allow the loan to be forgiven. However, administrators continuously amend the rules governing the PPP, and financial institutions have a hard time explaining the evolving conditions to loan holders.

“Even if it doesn’t get forgiven, I think the interest rate they’re going to charge us is a pretty good deal,” Kucharski said. “It’s a win-win scenario for us either way.”

Loans of more than $150,000 represent nearly 75% of total PPP dollars approved, but only a fraction of the number of actual loans. According to SBA, about 87% of all loans totaled less than $150,000. More than 91,000 trucking companies raked in just more than $2.1 billion in loans under $150,000. Texas led the way with $219 million, with California ($180 million) in second. Illinois (more than $164 million) rounded out the Top 3.

John Ganiev, owner of Philadelphia-based Dream Transportation, secured a $50,000 loan when the market receded, and the 200-truck dry van and reefer fleet with mostly owner-operators used the funds to cover payroll after drivers and office staff went home. Ganiev said he is trying to put the remaining funds to work to “generate more money” by hiring more people and investing in equipment and technology to “get back on my feet.”

Pennsylvania trucking companies such as Dream Transportation that received amounts under $150,000 soaked up $76.4 million of the state’s PPP funding. While Ganiev said he doesn’t think the PPP loan is a long-term solution, he is grateful that “it got me out of the hole. I’ve got better cash flow now, and everything is going good.”

Ganiev said he was told by a friend who is an SBA officer that his company may not be required to pay back the loan, adding his friend told him to take the money, use it and, if/when the first payment comes due, pay off the full amount.

CCJ Senior Editor Aaron Huff contributed to this report.