Used sleeper trucks and reefer trailers saw positive month-over-month activity in May, according to a report from Sandhills Global, while used day cabs and dry vans underperformed.

The report noted that inventory levels in the used heavy-duty truck market rose 3.9% month-over-month but fell 21.83% year-over-year, maintaining a steady trend. Used sleeper trucks led the most activity, with a 6.38% month-over-month increase but year-over-year decrease of 35.37%.

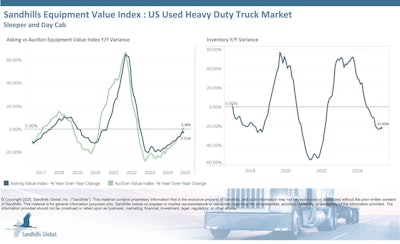

Asking value remained relatively stable, with a slight 0.19% increase month-over-month and a 2.51% decrease year-over-year. Sleeper trucks led again with the largest monthly increase (1.29%), while day cabs showed sharpest year-over-year decline at 5.26%.

Meanwhile, auction values ticked upward, gaining 0.67% month-over-month and 0.38% year-over-year. Sleeper trucks once again outpaced other categories with a 2.63% month-over-month gain, while day cab trucks saw a significant 7.10% auction value decline.

"Uncertainty has filled the truck market," said Truck Paper Manager Scott Lubischer. "Dealers are selling trucks, not because they are upgrades, but because people still need to operate. Dealers are lowering prices to drive sales, but they are feeling the effects of slowed port activity, lower freight volumes, and tariffs."

Trailer market

In the used semi-trailer market, Sandhills noted stability in inventory but differing pricing behavior, depending on trailer type. Inventory levels rose 3.41% month-over-month but was 11.2% lower than year-ago levels. Reefer trailers saw the largest month-over-month gain (10.49%), while used dry van trailers saw the sharpest decline at 18.29%.

Asking values in the used semi-trailer market trended upward at 0.91% month-over-month, though down at 2.92% year-over-year. Reefers led again with a strong 6.31% month-over-month increase, while flatbeds led the year-over-year decrease at 4.05%.

Auction values were mixed, with a 0.81% month-over-month decrease, but up 2.05% year-over-year. Notably, dry vans saw the largest auction month-over-month decrease (5.31%), while flatbeds had the largest year-over-year increase (3.67%).

[RELATED: Demand for late model used trucks surges despite inventory declines]

Follow the money

Though selling prices softened overall, used trucks with fewer than 400,000 miles, especially those under 300,000, continue to command strong prices, as buyers opt for newer used models over new trucks, according to J.D. Power’s June 2025 commercial vehicle market update report.

Used truck sales volumes moderately increased in May, aligning with market expectations, said Chris Visser, J.D. Power director of specialty vehicles.

When looking at late-model sleeper tractors, J.D. Power’s average pricing showed that 2023 models dropped the most in price (down 26.8%), while 2022 and 2020 models show moderate declines (-5.6% and -3.7%). 2021 models saw smaller decline at 1.1%, with 2019 units having the second largest decline (11.3%).

At auctions in May, selling prices for 4- to 6- year-old trucks averaged 3.7% lower than April, yet 23.9% higher than May 2024. Compared to the strong pre-pandemic market in 2018, pricing for this age group is still 20.3% higher in nominal terms, and 5.7% lower when adjusted for inflation.

Unlike previous years, Visser noted that J.D. Power hasn’t seen the usual influx of three-year-old trucks at auction by midyear, likely reflecting a mix of fleets extending truck life cycles.

“Some owners seem to be keeping their rigs in service longer than usual, possibly hedging their bets and taking advantage of freight available now while postponing the decision to trade for new,” Visser said. “Dealers are also choosing to recondition the newest trades and sell them retail, keeping them out of the auction channel.”

Due to the limited number of 2023-model trucks in the auction stream, Visser noted that monthly averages may be skewed based on mileage differences. The consistent trend, however, is that low-mileage trucks continue to bring premium prices.

Class 8 sleeper retail prices rose for the fifth consecutive month in May, though the increase was modest at under 1%. Retail sales per dealership also improved and continue to beat 2024 figures, reaching an average of 3.2 trucks sold, the strongest performance since June 2023.

Visser noted that evolving tariff policies will cause selective price increases across industry sectors. “Each new ‘deal’ announced adds incremental visibility to business planning beyond the next 30-90 days, but the trucking industry is still in a cautious frame of mind,” he said.

Demand for newer, low mileage used trucks continues to be sold mainly through retail channels, he added, as dealers find demand to invest in reconditioning and marketing.

Jimmie Jackson, vice president of sales at EquipLinc Auction Group, observed that prices have been going up for 2- to 3-year-old trucks with lower mileage as demand for late-model units is strong, while interest in brand new trucks declines.

“I believe this is mostly because of how expensive new models have become,” he said. “At the same time, there just isn’t a lot of quality used stock available, which will probably keep prices strong. Add in tariffs on parts and ongoing supply chain issues, and it’s likely we’ll see continued pressure on both availability and pricing.”

Financing is becoming tougher too, as “lenders are tightening up," Jackson said, "which is making it harder for some buyers to get approved even though demand is there.”