Gordan Moore, an Intel co-founder and the originator of Moore’s Law, passed away at the age of 94 this month.

His age allowed something unusual: he lived long enough to see his predictions from his draft 1965 paper, The Future of Integrated Electronics play out. Intel summarizes the law as predicting “the number of components it was possible to fit into a state-of-the-art microchip would double approximately every year for the next 10 years."

There was a cost angle to this as well. The prediction was that cost would decrease with increased density of components in each chip. The prediction is remarkable as it was based on only roughly six years of actual data, since the integrated circuit (IC) first was produced in 1959. Moore predicted that greater density in the IC design would lead to “such wonders as home computers[,] … automatic controls for automobiles, and personal portable communications equipment."

Theodore Wright was a somewhat earlier visionary from 1936. Wright, like Moore, applied actual data from production experience to predicting future costs. In this case, the experience was in building aircraft. An IEEE paper summarizes Wright’s Law saying, “the cost of a unit decreases as a function of cumulative production.” Again, what is remarkable is that these estimates were based on experience from the fledgling aircraft industry of the 1930s that had just begun building metal aircraft.

Given that both Moore’s and Wright’s predictions have since been labeled “laws,” their conclusions must immutably be correct, right? Everything built becomes cheaper with increased volume, and everything becomes more capable in time through increasing technology density per unit.

Both laws are seeing modern interpretations in envisioning trucking’s future. Battery electric, hydrogen fuel cell, hybrid among a variety of fuel choices, and autonomous vehicles all are seeing trajectories projected from modern day visionaries based on a very small sample of real vehicle production history. Are these visionaries going to be proven right in the long run?

The nature of history is to remember and promulgate the successes

Lost in the footnotes of time are the many contemporary inaccurate predictions. Every day, for example, thousands of predictions are published about where the stock market is going. Two months later, a handful of people are credited with “accurately predicting” such-and-such event, but how many didn’t? I still remember vividly the savings and loan crisis, the dot.com bubble bursting, the great recession, and most recently COVID. A lot of smart estimates prior to those events were substantially wrong.

We have short memories. Who lost the 2010 Indianapolis 500? The 1995 Super Bowl? The 2000 senate race in your district? What January 2020 predictions were just plain wrong about production and sales of trucks and trailers in 2020?

Moore and Wright did their homework and had confidence in their numbers. Still, their predictions were based on nascent industries and, quite frankly, there was some degree of luck on their sides. Politics, mother nature and human nature are pretty challenging to accurately predict. Look at freight payload per vehicle as an example.

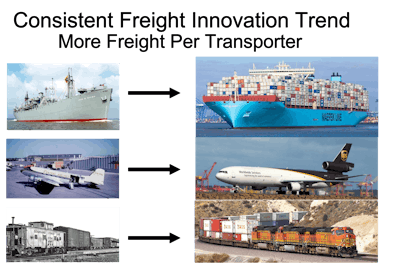

The freight capacity per vehicle per human operator has increased dramatically since the 1940s — for ships, trains and airplanes. I first published this graphic in 2016 for a presentation for Stifel Transportation Equipment Equity Research on Envisioning Future Commercial Vehicles, and then concurrently in my SAE report, Fuel and Freight Efficiency - Past, Present and Future Perspectives. A picture tells a thousand words or more. All three of these freight transport modes have seen expansive growth in capacity per-vehicle and per-crew.

What is woefully absent in this time frame is any significant per-vehicle capacity growth for trucking. Combined with hours of service limitations, the freight hauled per-truck and per-driver has been effectively capped for decades. One can even argue that with the growth of ecommerce and in individually packaged freight, that the capacity of trucks may have actually decreased over the last two decades as shippers haul more air than freight. There are a few exceptions to this where in states like Washington, Idaho, Oregon and Nevada are able to run triples and doubles on some routes.

Rick Mihelic

Rick Mihelic

Advocates of Moore and Wright would have you believe that technology components like batteries, fuel cells, high pressure hydrogen tanks, autonomous truck computer sensors, will all see dramatically reduced costs in time because of volume growth. That may be true for some components that are shared between automotive and medium- and heavy-duty trucks. But seriously, look in today’s trucks. How much do see that is actually shared with automotive?

Look also at the math. If my truck factory produces 1,000 vehicles this year, and I double that rate every year, in 10 years I’m producing more of the same truck – 512,000 – than the entire market size of all models and all makers combined.

What market can absorb one truck in such volumes? Realistically, heavy-duty trucking has more than 10 heavy-duty truck manufacturers introducing products with these new technologies. Their customer bases expect some level of model and option choices. How many models will have the same parts? Traditional data for diesels suggests that the market will be split with a few big players having 30%-plus market share, and then the rest scrambling for 10% to 15%. The more players there are, the lower the market share potential for each maker.

Where are the volume pricing breaks?

Each manufacturer likely wants to have brand differentiation, and even model differentiation. If a fuel cell truck has, for example, five 700-bar hydrogen tanks per vehicle, and the manufacturer makes 10,000 units a year, that would be 50,000 tanks. Add in some level of replacement parts, say 20%, or another 10,000 tanks. Are 60,000 tanks per year enough to see significant production volume savings that Wright’s Law would predict?What if everyone selling fuel cells built tanks of the same design, conforming to one specification, and fuel cells represented (optimistically) 50% of annual truck sales for the industry? With spares you might exceed one million similar units a year. There is perhaps opportunity there to decrease production costs versus making a few thousand a year.

Can individual brands competitively coexist where significant volumes of vehicle components come from the same specification? Look at axles and transmissions on current diesel trucks. There are examples where the market has harmonized on specific products and still found room for manufacturers to provide brand differentiation to their customers.

Another example is brand differentiation of gasoline and diesel. The fuel, meeting common standards, is co-mingled from the refineries through the pipelines and storage facilities. Still, brand differentiation has been accomplished by the various fuel makers.

Batteries in particular seem particularly in need of a level of standardization because they will need to be salvaged and repurposed for second life uses once their usefulness for hauling freight is exhausted. Those second life users will need some level of standardization to ensure the supply of used batteries is compatible with those second market systems.

There is always a significant push to reduce variation at companies at the start of new product programs. That inevitably runs into headwinds. While most involved parties agree that commonality is desired, they vehemently disagree on the details. Common systems very quickly become common in name only. You see this at component suppliers where the same part may have multiple OEM part numbers because some minor difference has crept into the design. Sometimes, the same part has different part numbers for defensive reasons; simply because of fear that if it is truly shared, the design may change when a particular vehicle maker does not want it to.

While brand differentiation will continue to be important to vehicle manufacturers, losing sight of the forest through the trees is possible. The bigger issue with the new technologies of battery electric, hydrogen fuel cell, autonomous vehicles, etc., will be cost. None of these vehicles will be less expensive to build than legacy diesel products. Downstream operating expense reductions will significantly help the total cost of ownership, but purchase price reduction will, as always, be an ongoing necessity. Where will those cost reductions occur? How will they be significant enough to impact the market trajectories of the technologies? How can the manufacturers increase production volume while maintaining product differentiation? All these questions loom as we get past prototypes and into production of these new technologies.

Moore and Wright saw significant cost reduction in their futures from increased volumes. Can trucking meet these expectations? What will regulators, manufacturers and fleets jointly do to reduce the costs of the new technologies?