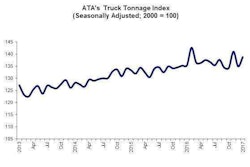

Bottom line, Costello noted, “there’s more freight coming our way.” He projected a 2.6 overall increase in tonnage after being essentially flat in 2016.

Bottom line, Costello noted, “there’s more freight coming our way.” He projected a 2.6 overall increase in tonnage after being essentially flat in 2016.Carriers should, if current indicators hold true, prepare for better freight volume in 2017, said American Trucking Associations Chief Economist Bob Costello.

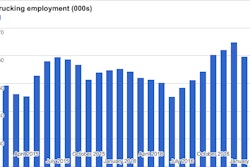

Costello laid out a picture for 2017 around trends affecting freight and, consequently, driver pay for the recruiting/retention-specialist audience at Conversion Interactive Agency’s annual conference in Nashville, Tenn. With a focus on driving decisions in hiring, leasing and ongoing employment through data, the event’s theme was of a piece with Costello’s message, that indicators reveal fleets would do best to prepare for growth in the coming years.

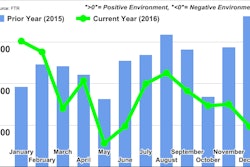

While overall economy growth was tepid in 2016, and a freight recession through much of the center part of the year hampered a lot of growth for trucking companies, some key indicators related to consumer spending have been stronger. Compared to overall economic growth at less than 2 percent, for instance, consumer goods consumption rose by nearly 4 percent in 2016, Costello said. He projected that growth number to hold around 4 percent over subsequent years as well.

“This will help freight going forward,” he added. The housing market, too, has been proceeding at a good pace, with “2.1 million new homes [built] this past year,” way up from the 2010 low of about 550,000. Costello expected continued growth to benefit building-materials haulers at a “good sustainable pace at this moment.”

Also, after 2014, which Costello noted “could go down as the greatest year in trucking” in terms of improved rates, freight availability, profitability and more – “It was so tight, full truckloads were getting moved into LTL” – the unsustainable nature of the rise led to a glut of inventories stocked around the nation. Finally, in a trend that begin last year and continues, “we’re clearing out that glut of inventories throughout the supply chain,” Costello said, a positive factor for freight availability coupled with continued strong goods-consumption growth.

A countervailing factor in factory output growth rates – which haven’t “been very good as of late” – could temper some of the gains. While the growth rate has been down after averaging 3 percent a year between 2010-14, it’s started to creep back to that rate. “I continue to be bullish on North American factory output” in spite of the North American Free Trade Agreement wildcard, Costello noted. If a stalemate on renegotiation or some other as yet unforeseen big shift occurs, however, it could temper any gains there in a big way. But Costello believed that was fairly unlikely, with factory output most likely to get “back up to that 3 percent growth rate after being down for several years. … Factory output is moving in the right direction – it’s a little soft, but moving up.”

Bottom line, Costello noted, “there’s more freight coming our way.” He projected a 2.6 overall increase in tonnage after being essentially flat in 2016.

See recent reporting on the 2017’s freight outlook at the links below.