The U.S. freight market closed 2025 in a fragile state but is showing some signs of a long-awaited upturn after a historically long and devastating downcycle that began in April 2022. As readers of this publication know all too well, shipment volumes have remained weak from late 2022–2025, although with some late-year 2025 tightening showing up in both trucking and ocean markets. Current data from Cass, DAT, and Drewry confirm a modest firming into year-end 2025, but pricing power remains tentative and mixed by mode.

Tracing the circuitous routes that led us to this point gives us context but successfully navigating this volatile path toward recovery means adopting a data-focused approach centered on monitoring the market closely, preparing contingency plans, and diversifying to remain fluid and adaptable in 2026.

The numbers don’t lie

According to the Cass Freight Index, shipments rose month-over-month in November (seasonally adjusted) but remained down year-over-year. The November 2025 shipments index printed at 1.004 (base Jan 1990=1.00). This follows a pattern of consecutive annual declines since 2023, with 2025 tracking lower versus 2024.

Cass Transportation Index Report – November 2025 (Shipments 1.004), Cass Freight Index archives and YCharts monthly series for 2025.

Cass Transportation Index Report – November 2025 (Shipments 1.004), Cass Freight Index archives and YCharts monthly series for 2025.

How we got here: from boom to overbuild

From 2020 to early 2022, pandemic-driven e-commerce and supply-chain rebuilding inflated demand and rates. Carriers responded by expanding capacity in the form of buying trucks and trailers and aggressively hiring drivers, only to meet normalized consumer demand and falling volumes from late 2022 to the end of 2025. As a result, excess capacity, compressed margins, and contraction were all experienced across the for-hire trucking, dedicated fleet, and transportation equipment manufacturing sectors.

Carrier casualties and margin compression

Owner-operators and smaller fleets absorbed the brunt of the rate deflation while fuel, insurance, and maintenance costs remained elevated. Small fleets are also competing with undocumented drivers and drivers with counterfeit CDL’s being paid a fraction of what small fleet owners are paying in wages and benefits.

Owners, on the other hand, were faced with the prospect of losing money on parked trucks versus running the trucks and losing money on nearly every load hauled. However, fleet exits and enforcement efforts throughout 2025 resulted in capacity bleed, setting the stage for late-year tightening when seasonal demand spiked.

Supply chain domino effect

Weak freight volumes sent ripples into logistics, warehousing, and port operations, with resulting consolidations and furloughs. Because freight is a leading indicator for goods movement, persistent softness in shipments has signaled broader manufacturing headwinds.

Late-2025 inflection: truckload tightens & prices rise

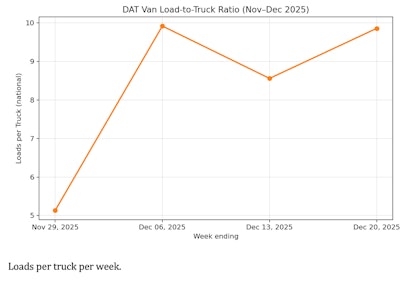

DAT’s national Van Load-to-Truck Ratio (LTR) spiked post-Thanksgiving: 5.13 (week ending Nov 29) to 9.92 (Dec 6), then 8.56 (Dec 13) and 9.86 (Dec 20). The surge reflects holiday effects, weather, and ongoing capacity exits, bringing temporary tightness to spot lanes and finally some long sought after rate relief to carriers.

In addition, the Logistics Managers Index (LMI), published by Colorado State University has their transportation pricing index at 66.7, indicating transportation prices expanding at a faster rate of change (any score above 50 represents growth). This is the third month in a row that this index has increased.

DAT Van Demand & Capacity Trendlines (weekly LTR prints) and C.H. Robinson December 2025 market update referencing the 9.9:1 spike.

DAT Van Demand & Capacity Trendlines (weekly LTR prints) and C.H. Robinson December 2025 market update referencing the 9.9:1 spike.

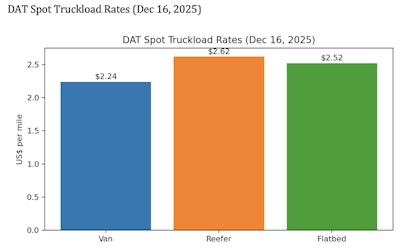

Scale Funding summary citing DAT Trendlines (Dec 16, 2025): Van $2.24/mi, Reefer $2.62/mi, Flatbed $2.52/mi; corroborates late-year firming in national averages.

Scale Funding summary citing DAT Trendlines (Dec 16, 2025): Van $2.24/mi, Reefer $2.62/mi, Flatbed $2.52/mi; corroborates late-year firming in national averages.

Ocean freight: stabilization via GRIs and decreased blank sailings

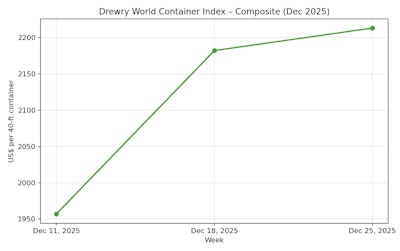

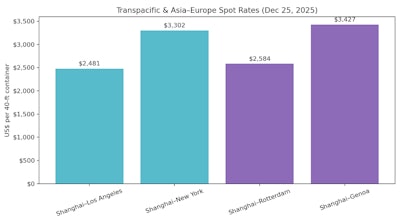

Drewry’s World Container Index (WCI) composite rose into year-end: $1,957 (Dec 11) → $2,182 (Dec 18) → $2,213 (Dec 25), marking four straight weekly gains. Transpacific spot rates held steady in the week of Dec 25 after double-digit increases earlier in December, while Asia–Europe lanes continued to firm on carriers’ pricing discipline and early Lunar New Year bookings.

The term “blank sailings” refers to scheduled voyages that are intentionally canceled or skipped by a maritime shipping company. This can involve skipping a port stop or canceling the entire voyage. Blank sailings are used to manage costs or changes in demand. An increase in blank sailings is a sign of the maritime industry in distress.

- Blank sailing rates remain elevated and volatile compared to pre-pandemic levels.

- Industry benchmarks: ~12% in 2021–22, peaking at 21% during 2023 busy/holiday windows.

- Recent stabilization around 5–10%, but absence of full normalization: carriers continue to actively manage capacity with cancellations.

Drewry World Container Index weekly assessments (Dec 11/18/25) and route snapshots (Shanghai–LA $2,481; Shanghai–NY $3,302; Shanghai–Rotterdam $2,584; Shanghai–Genoa $3,427).

Drewry World Container Index weekly assessments (Dec 11/18/25) and route snapshots (Shanghai–LA $2,481; Shanghai–NY $3,302; Shanghai–Rotterdam $2,584; Shanghai–Genoa $3,427).

Modal mix: truckload vs. LTL and intermodal

Cass commentary through fall 2025 indicates a mode shift from LTL to truckload within a generally weak demand backdrop, with FTL volumes occasionally improving while LTL remains pressured. This mix change helps explain periods when expenditures edge higher even as shipments lag.

Carrier frustration and policy pressure

As rates approached or fell below break-even for many for-hire carriers, fleets sought relief via contract resets and regulatory engagement. Transportation related OEMs reduced production capacity in response to soft customer demand, while shippers leveraged a still-loose market outside seasonal pockets.

Outlook for 2026: cyclical low or structural reset?

Excess capacity is slowly being absorbed, pointing to a gradual, uneven recovery but tariffs, trade negotiations, and cost inputs could mute demand and delay normalization. If this is a structural reset, networks will need to right-size to a lower equilibrium; if cyclical, those who cut too aggressively risk ceding share when volumes return.

What shippers and carriers should do now

To navigate the current market volatility and prepare for potential recovery in 2026, I recommend that shippers and carriers adopt a proactive, data-driven approach:

- Diversify contract structures

Move away from rigid, long-term agreements. Instead, incorporate shorter contract terms combined with indexed components tied to market benchmarks. This strategy helps hedge against fluctuations in the spot market and reduces exposure to sudden rate swings. - Develop robust contingency plans

Create detailed playbooks for high-risk periods such as holidays and severe weather events. These plans should include alternative routing, pre-booking strategies, and capacity commitments to avoid last-minute reliance on expensive spot freight. - Monitor key market indicators

Track the following metrics regularly:- Load-to-Truck Ratio (LTR) – Published by DAT, this ratio measures freight demand versus available capacity.

- Tender Rejection Rates – Indicates carrier willingness to accept contracted loads; rising rates signal tightening capacity.

- World Container Index (WCI) – Establish clear procurement triggers based on these indicators to shift between contract and spot strategies efficiently.

- Right-size assets and optimize driver deployment

Adjust fleet size to align with current demand. Redeploy drivers to higher-yield lanes where revenue per mile is strongest. Implement rigorous preventive maintenance programs to reduce Total Cost of Maintenance (TCM) and extend asset life. Schedule maintenance when your historical data shows slow activity weeks. - Collaborate on peak and disruption playbooks

Work closely with core logistics partners to co-create operational plans for seasonal surges and unexpected disruptions. These playbooks should balance service continuity with cost control, leveraging shared resources and real-time communication. - Consider Dedicated Contract Carriage (DCC) as a strategic alternative

Recognize that the freight market is shifting back to some semblance of normalcy, which will almost certainly result in higher rates. With DCC, shippers who act now can lock-in cost stability, build supply chain resilience with secure capacity, and elevate service quality.