The final quarter of 2025 indicated subtle and meaningful shifts in the truckload market, according to a new report.

U.S. Bank and DAT Freight & Analytics launched a new quarterly research report on U.S. truck freight rates, offering shippers and carriers a view on truck freight costs, including average-per-mile contract, spot, and fuel rates. The report complements the existing U.S. Bank Freight Payment Index, which has been published quarterly since 2017.

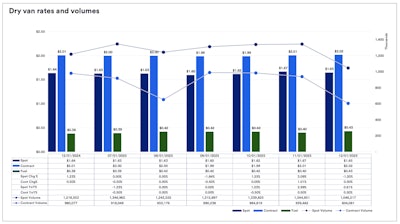

According to the report, spot rates rose 3% in October, then fell 1.1% to $1.65 per mile in November. Contract rates have been steady in recent months, coming in at $2.02 in November. Both spot and contract rates are up less than 1% compared to a year ago. The modest gain reflects normal seasonal patterns rather than structural change, the report noted, as holiday demand typically influences annual comparisons.

Jeff Pape, general manager of U.S. Bank Freight Payment, said the October spike followed by November’s pullback is expected behavior.

“Our data indicates this is primarily seasonal volatility,” Pape explained, noting that these short-term fluctuations are typical for this time of the year. “We’re also seeing underlying capacity changes in the market, which we’ve been tracking in our Freight Payment Index.”

There are also regional differences in the market: the Northeast is seeing stronger freight flows outbound, fueled by manufacturing and retail activity. Meanwhile, the Southeast is struggling with weaker employment conditions and reduced consumer spending, creating softer demand in that region.

Fuel surcharges remained relatively stable in Q3 2025 and into October, but November indicated a sharp 7.5% jump, largely due to refinery outages in the Gulf Coast and Midwest.

The November jump stood out, as national diesel prices dropped that month. The report highlighted an important reality: “Fuel surcharges don’t always track pump prices in real time, so it pays to keep a close eye on how those fees are calculated and updated. Fuel surcharges have stayed steady for now, but any further supply disruptions could push costs higher, especially in the Midwest.”

Windows of opportunity

October indicated a shift as the gap between contract and spot rates narrowed. The report said shippers used the opportunity to revisit lane agreements and conduct targeted bidding exercises, while carriers used November’s gap as a chance to lock in contracts where margins improved.

The seasonal volume decline for both spot and contract loads in November offered advantages, the report said. Shippers used it to test routing guides and see if primary carriers had capacity headroom. Carriers, meanwhile, focused on locking in commitments for early 2026 when freight activity typically accelerates.

Capacity constraints loom

A significant shift is underway as carrier exits are outpacing new entrants, driven by new regulations and elevated operational expenses, the report noted.

“This shrinking pool of available trucks has not yet caused a dramatic spike in rates, but it sets the stage for rapid increases if freight demand rebounds,” it said.

When asked about muted year-over-year rate growth, Pape pointed to competing forces at work.

“The market is being pulled in two directions: softer economic indicators – mixed manufacturing activity, weaker job markets, and lower household spending – are keeping demand muted, while tightening capacity and tariff‑driven shifts are pushing shipping costs higher,” he explained. “A major factor is the steady exit of carriers and the increasing difficulty fleets face in securing equipment, which puts upward pressure on rates even as demand softens.”

Pape said carriers watching for signs of a market inflection point should focus on fundamental economic drivers of freight, such as manufacturing activity, housing starts, retail activity improvements and housing spending trends.

As economic conditions stabilize, Pape said “capacity constraints may become the dominant force, setting the stage for upward pressure on rates.”

Policy impacts run deep

The report also pointed out that trade policies and tariffs left their mark in 2025. A 25% tariff on Mexico-assembled trucks increased equipment expenses, especially for fleets operating near the border and in major import corridors.

The tariff announcements typically trigger a predictable cycle, the report said. Shippers rushed to move freight ahead of implementation, creating temporary demand spikes and rate increases, followed by quieter periods as elevated inventories get drawn down.

Regulatory changes around driver qualifications and language requirements are constraining capacity further, the report noted, particularly in California and the Southeast.