The national freight market saw modest growth in demand late last year, yet available capacity continued to shrink even as transportation spending hit its highest point since early 2024.

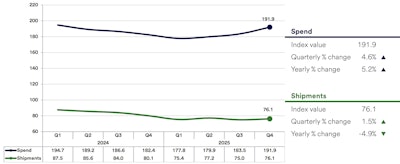

According to the U.S. Bank Freight Payment Index report, national shipments increased 1.5% from Q3 2025, while spending rose 4.6% in the same period.

The last quarter of 2025 saw muted demand, the report noted.

Factory production was stagnant for four straight months, while the ISM Manufacturing index saw its weakest point since October 2024. Retail sales figures through October were flat from September and only rose slightly above inflation on an annual basis.

"The capacity story is the defining theme of Q4. Shippers paid significantly more to move slightly more freight — clear evidence that available truck capacity continues to tighten," said Bobby Holland, U.S. Bank director of freight business analytics. "Between fleet exits and carriers reducing their rosters, the industry is feeling the effects of prolonged contraction."

[Related: Spot and contract rates hold steady in 2025, but shrinking carrier pool signals trouble ahead]

Several dynamics drove the capacity squeeze.

The report noted that prolonged market weakness compressed freight rates, pushing carriers to downsize fleets and reduce the number of independent contractors. Federal Motor Carrier Safety Administration data noted that total carrier count also fell during the period.

Meanwhile, increased regulatory oversight sidelined thousands of drivers. The Department of Transportation temporarily halted certain issuance of non-domiciled commercial driver’s licenses to certain non-citizens and non-permanent residents pending full regulatory compliance, although a court case has since delayed enforcement.

Industry capacity contracted in Q4, according to the report, pushing freight costs higher despite peak season volumes falling short of historical norms.

“Spot market rates climbed quarter-over-quarter and year-over-year, highlighting tighter capacity across the freight sector,” it said.

Regional breakdown: mixed volumes, all-around cost increases

At a national level, shipments rose 1.5% from Q3 2025 but was down 4.9% year over year. Spending increased 4.6% quarter over quarter and climbed 5.2% compared to the same period in 2024.

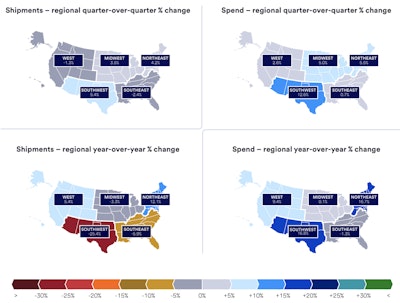

On a regional basis, spending climbed across all regions, though shipment trends were mixed.

In the West, shipments declined 1.3% from the previous quarter but increased 5.4% year over year. Spending rose 2.6% from the previous quarter and jumped 9.4% annually. Despite the quarterly dip, freight volumes in the West rose 3.2% for the full year 2025 compared to 2024.

Reduced port activity and cautious consumer spending subdued freight volumes, but annual shipments rose, supported by trade policy changes in 2025 and increased imports.

The Southwest saw a challenging freight market with the sharpest drop in annual shipment average among all five regions, declining 31.6% from 2024. Shipments surged 5.4% quarter over quarter but plunged 25.4% year over year. Spending climbed sharply, up 12.6% from last quarter and 16.8% annually. Despite soft freight volumes, stricter regulatory enforcement likely played a role in tightening capacity and the sharp rise in shipping costs, the report said.

Midwest shipments improved 3.5% from the previous quarter but slipped 3.3% year over year. Spending rose 5% sequentially and edged up just 0.1% annually. The region’s freight activity improved despite mixed manufacturing indicators and modest reductions in cross-border traffic from Canada.

The Northeast led all regions with a 4.2% quarterly shipment increase and a 12.1% annual gain, marking its fourth straight quarter of volume growth. Spending rose 5.5% from the previous quarter and rose 16.7% compared to the prior year. Manufacturing growth and strong consumer activity among higher-income households influenced the boost.

In the Southeast, shipments declined 2.4% from the last quarter and 5.9% year over year. Spending only rose slightly at 0.7% from the prior quarter but declined 1.3% annually. The report pointed to consumer hesitancy and disruptions related to the federal government shutdown as factors that affected the region’s freight activity.

Despite various volume patterns, every region posted higher spending compared to the previous quarter, and four out of five regions showed year-over-year spending growth. This is another indication of constrained capacity in the market, the report said.