Increasing costs and artificial intelligence will significantly drive the regional and national moving industry this year, according to a recent report.

Residential relocations underperformed last year, but pent-up demand and expected lower interest rates will make 2026 stronger. Meanwhile, commercial relocations will be constrained by excess inventory and changing norms, said David Cox, president of JK Moving.

Escalating expenses present the biggest challenge, said Cox, while AI presents the potential to streamline business and improve the customer experience.

[RELATED: Geotab's 2026 prediction: AI-driven boom for fleets that adapt]

In 2025, homeowners postponed purchasing or listing homes as anticipated mortgage rate decreases failed to occur, according to JK Moving’s 2026 Outlook report. Interest rates will remain a crucial element influencing the housing market this year, the report stated, though trade groups, including the National Association of Realtors, anticipate declining rates. Regardless of interest rate activity, JK Moving anticipates that consumers will stop waiting and proceed with their moves, as rates have remained elevated for three consecutive years.

Migration patterns and motivations

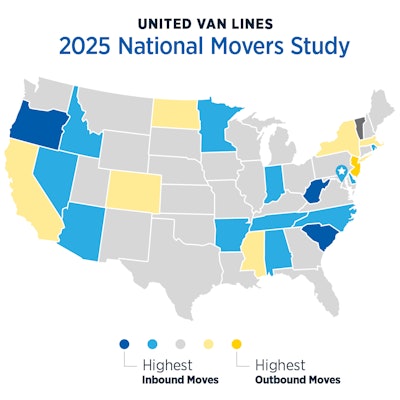

American migration patterns are also shifting, according to a study by United Van Lines, moving away from purely economic motivations toward more family-oriented and lifestyle-focused decisions.

The primary driver for interstate moves was the desire to live closer to family (29%), followed by employment opportunities such as new positions and company transfers (26%), and retirement planning (14%).

Geographic trends favor the South and West, though with some exceptions. Oregon rose as a leading destination for inbound relocations (65%), attracting job-seeking residents, particularly in the technology and healthcare fields. The Carolinas, West Virginia, and Delaware also saw substantial activity.

Meanwhile, the Northeast reported significant departures, with New Jersey leading outbound migration at 62% for the eighth consecutive year, followed by New York and California (both at 58%). However, some states, like New Jersey, are attracting younger professionals who view the area as a “launching pad,” while retirees seek lower costs and different lifestyles.

There is also a migration trend toward smaller metropolitan areas and towns outside major urban centers where housing is more affordable. Leading destination metros include:

- Eugene-Springfield, OR: 85%

- Wilmington, NC: 83%

- Dover, DE: 79%

Commercial moves, dissolved government agencies and international relocation

Besides rising costs and technology’s impact on business operations, JK Moving’s report noted that the nationwide office vacancy rate will hit 24% in 2026. The shift to remote or hybrid work has transformed commercial office moving, reducing demand for traditional services.

As companies transition to digital records, there is less physical material to relocate. “All these factors have had a negative impact on commercial real estate. Many markets are starting to convert commercial space into residential,” the report noted. Consequently, many relocation companies are expanding into related sectors, such as warehousing; furniture, fixtures, and equipment (FF&E) services; and final-mile delivery. Diversification is key to remaining competitive in the logistics and moving industry.

International moves have also created a niche in the industry as remote work and globalized employment continue. JK Moving noted that certain companies focus on the specific details involved with international relocation, whether moving overseas or immigrating to the U.S. Expert international movers assist clients in managing the challenges of regulations, taxes, fees, and varying customs.

Additionally, major policy changes by the new administration have substantially affected the moving and relocation industry as individuals lost employment, government agencies dissolved (including USAID), and local businesses supporting federal operations closed. Conversely, a spike in retirements occurred, with JK Moving noting an increase in relocations to retirement communities in the Carolinas and Florida.