The trucking industry continues to face challenging conditions, showing modest improvements in some indicators but persistent weakness in demand.

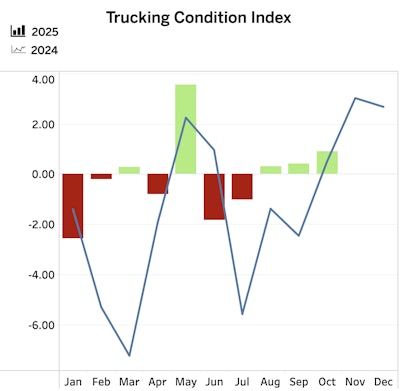

FTR’s Trucking Conditions Index (TCI) rose slightly to 0.89 in October from 0.42 in September, with a mildly positive outlook for carriers through the forecast horizon. The TCI examines key elements of the U.S. trucking market: freight volumes, freight rates, fleet capacity, fuel prices, and financing costs. Positive readings signal favorable conditions, negative readings reflect challenging conditions, and values near zero indicate a neutral environment.

However, Avery Vise, FTR’s vice president of trucking, noted that the 43-day government shutdown and a lack of government economic data have complicated industry analysis.

“The Federal Reserve recently disclosed that manufacturing output since 2022 has been substantially weaker than previous figures indicated, including in certain capital goods needed for future industrial production,” Vise said.

Meanwhile, ACT Research reported that its For-Hire Trucking Index showed a decreased supply-demand balance in October as both freight volumes and capacity declined. The Volume Index fell by 8.1 points to 47.0 points in October from September’s 13-month high of 55.1.

Carter Vieth, research analyst at ACT Research, attributed this drop to a “payback period” following earlier pull-forwards. He stated, “While consumers have so far remained resilient, evidence from industry participants points to a muted holiday season, with many equipment suppliers seeing soft demand ahead of the holidays.”

Other key freight-generating sectors are struggling, Vieth noted. Manufacturing and housing remain stagnant, while data center investment continues to grow and keeps the economy afloat, though it generates minimal freight volume.

ACT Research’s Capacity Index decreased 0.7 points to 46.8 points in October from 47.5 in September. Vieth attributed the shrinking capacity to sustained unprofitability, alongside other factors such as private fleet pullbacks and small fleet failures.

Despite these reductions, Vise believes carriers might need to cut capacity further to achieve a “reasonable level of utilization,” adding that the only real catalyst for solving the industry’s issues is stronger and sustained freight demand.

Tariff impact

Tariff policies have created short-term disruptions and long-term cost increases, Vieth pointed out.

The pre-tariff freight surge has given way to a demand air pocket in Q4, creating uncertainty. Ken Vieth, ACT president and senior analyst, noted that the recently enacted Section 232 tariffs place a 25% levy on foreign content in imported medium- and heavy-duty trucks and buses, pushing up equipment costs.

Carter Vieth noted that while tariff cuts have begun, “goods inflation may pick up as pre-tariff inventories are depleted,” potentially weighing on freight volumes. However, he suggested that “lower tariffs and the end of the tariff payback may support a recovery.”

[RELATED: Class 8 November orders drop as carriers prioritize survival over growth]

Equipment demand outlook

ACT Research also noted that new tractor demand remains weak across the board. Uneven growth in freight-generating sectors, uncertain economic policy, and lingering overcapacity have slowed the recovery from the prolonged recession.

Though there has been recent clarity regarding EPA ’27 regulations, Ken Vieth emphasized, “Truckers buy trucks when they make money. While regulatory clarity is helpful, at current low levels of carrier profitability and returns on investment, barring an unforeseen shift in economic fortunes, a tractor pre-buy is highly unlikely but could spur some marginal activity later in 2026 as supply-demand conditions for carriers improve.”

The vocational market faces similar challenges from policy shifts related to tariffs, federal funds, and emissions regulations. However, long-term trends in utilities, roads, and data centers remain positive for construction-related vocational equipment.