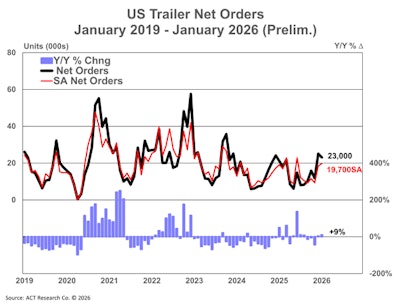

ACT Research pegged U.S. trailer net orders at roughly 23,000 units in January — about 2,000 units, or 8%, below December’s 25,100-unit tally.

FTR Transportation Intelligence reported that U.S. trailer net orders were essentially flat at 24,206 units, continuing December’s relative strength, though orders were 4% below year-ago levels and below the 10-year January average of 26,340 units.

Though there’s been recent demand stabilization and some improvement, the 2026 order season (September 2025 to January 2026) remains 16% behind the prior-year pace, FTR said.

The order flow appears to reflect a mix of factors, FTR reported: a gradual release of deferred orders that built up between September and November; healthier carrier fundamentals as shown with FTR’s Trucking Conditions Index hitting its best reading since February 2022 in December; firmer freight rates and tighter capacity; outsized spot-rate increases in December and January (the latter driven by weather); fleets pulling forward purchases ahead of further tariff-related cost past-throughs; and improved capital planning after better Class 8 regulatory clarity.

[Related: ATA asks EPA to revisit its looming NOx rule as OEMs eye 2027 engine launch]

While positive freight indicators and regulatory clarity offer a boost to the U.S. trailer market, FTR senior analyst of commercial vehicles Dan Moyer said manufacturers and fleets are still navigating cost inflation and trade policy uncertainty that impacts pricing and demand.

“The Trump administration reportedly is considering a narrower approach to certain Section 232 steel and aluminum tariffs,” Moyer said. “That move could ease cost pass-through pressures at the margin, though no formal policy change has been announced.”

Moyer also flagged growing trade risk in the dry van segment, where an antidumping and countervailing duty proceeding is advancing.

Even though any potential changes from the investigation could be months away, Moyer noted that it is likely already shaping sourcing strategies and pricing decisions.

“Overall, existing metal tariffs and the advancing van investigation likely will keep costs elevated and demand selective,” he said.

ACT’s director of CV market research and publications Jennifer McNealy said the sequential decline was not surprising as December is usually the second strongest order month of the annual cycle.

“January is usually the month when trailer makers begin to take fewer orders and start to work down the backlog that grew during the peak of order season, October through December,” McNealy said.

January orders still came in on the high side of expectations, McNealy added, motivated by December’s weather-driven freight rate spike, increasingly aged fleets, and some degree of tariff-related policy clarity that offered a nudge to equipment demand.

U.S. trailer production ticked up in line with seasonal norms but remains subdued, hovering near the lowest levels recorded since late 2010, FTR noted. Net orders outpaced builds by a wide margin, increasing backlogs, though they remain well below January 2025.